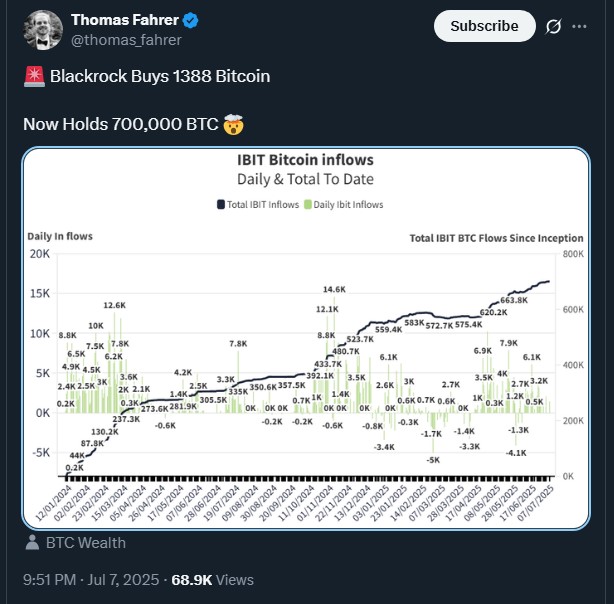

BlackRock’s iShares Bitcoin ETF just crossed a major milestone—over 700,000 Bitcoin now under management. This move isn’t just about numbers; it signals a shift in how institutional finance is embracing Bitcoin.

IBIT’s 700K BTC Holding: Bitcoin Goes Institutional

BlackRock’s iShares Bitcoin Trust (IBIT) now holds more than 700,000 Bitcoin, valued at around $75.5 billion. That’s over 55% of all Bitcoin held across U.S. spot Bitcoin ETFs. Since launching in January 2024, IBIT has delivered a return of more than 82%, making it one of the most successful crypto investment products so far.

This shows a clear trend—traditional finance is no longer avoiding Bitcoin. Instead, it’s becoming a core part of institutional portfolios. As a result, Bitcoin is slowly moving from a speculative asset to a long-term store of value for big players.

With demand far outpacing supply, Bitcoin is becoming scarcer each month. This imbalance can create upward pressure on price over time, especially as more funds and companies continue to accumulate. It’s a sign that Bitcoin’s limited supply is becoming more significant as adoption grows.

Solana ETF Deadline Update

The U.S. Securities and Exchange Commission (SEC) issued new streamlined guidance aimed at shortening the crypto ETF approval process, cutting review time from ~240 days to about 75 days.

Following the successful launch of the REX‑Osprey Sol + Staking ETF, the SEC moved to fast‑track spot Solana ETF applications, asking issuers to refile S‑1 documents by July 31. Approval could come before the formal October deadline.

This shift signals greater regulatory clarity and faster access to crypto funds. As approvals accelerate for Solana—and eventually XRP, Dogecoin, Litecoin—investors may see increased options beyond Bitcoin and Ether.

Final Thoughts

From BlackRock’s growing Bitcoin dominance to a regulatory environment warming up to crypto ETFs, the signs are clear: institutional involvement in crypto is deepening. Investors—both large and small—are finding more ways to access Bitcoin and other digital assets through regulated, familiar financial tools. As these trends continue, the crypto market is becoming more mature, accessible, and relevant in global finance.

Latest Crypto News;

- Elon Musk’s America Party Backs Bitcoin: “Fiat Is Hopeless”

- Why Bitcoin and Gold Outperformed Stocks, Commodities and S&P 500

- Drake’s Crypto Journey Hits a New Beat “What Did I Miss?”

- How M2 and Stablecoin Liquidity Drive Bitcoin’s Next Price Cycle

- After 14 Years Two Mysterious Bitcoin Wallets have Moved 20,000 BTC

- 3 Key Drivers of Bitcoin’s Upcoming Breakout

- Coinbase Buys Liquifi While Tether Faces $4B Lawsuit

- Bitcoin ETF Momentum, Trump-Backed Bitcoin Mining,

- Crypto Market News & Updates Jun 30, 2025

- Robinhood Launches Micro Bitcoin, Solana, and XRP Futures

- Bitcoin Hits $40B in Derivative Market

- Why US Crypto Stocks Surged?

- Crypto News: Bitcoin Rebounds, Coinbase MiCA license, OKX IPO

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market