Solana ETF Race Heats Up: Invesco and Galaxy File for Spot ETF

With nine firms now seeking approval for Solana ETFs, the race is intensifying. Invesco and Galaxy Digital are the latest to join, signaling that institutional demand for Solana is growing beyond Bitcoin and Ethereum.

Invesco and Galaxy Digital jointly filed a Form S-1 registration with the U.S. Securities and Exchange Commission (SEC) to launch a spot Solana ETF. The proposed product, named the Invesco Galaxy Solana ETF, would directly hold Solana (SOL) and track its real-time spot market price.

This filing makes Invesco the ninth asset manager to enter the Solana ETF race, alongside firms such as VanEck, Bitwise, and Grayscale. The ETF would trade on the Cboe BZX Exchange under the ticker symbol QSOL, with Coinbase Custody providing safekeeping for the underlying tokens.

The fund also leaves room for staking a portion of its SOL holdings, which could generate additional rewards and income for the trust. Similar language about staking has also been added by other ETF applicants in their updated filings.

Will the SEC Approve Solana ETFs Soon? Analysts Predict a Decision by July

ETF experts believe the SEC may act earlier than expected, potentially giving the green light to Solana ETFs in the coming weeks.

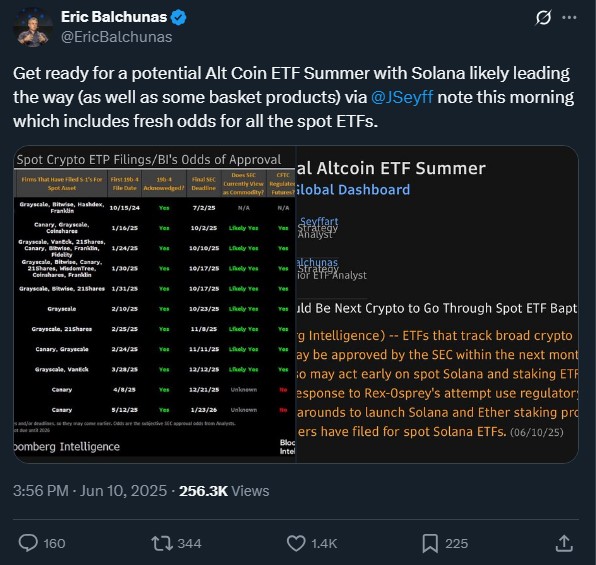

According to Bloomberg ETF analyst James Seyffart, the SEC might start reviewing spot Solana ETF applications by July. His colleague, Eric Balchunas, echoed the optimism, suggesting a strong possibility that all nine Solana ETF filings could be approved simultaneously.

That could lead to a synchronized launch across issuers, avoiding a first-mover advantage for any single fund. The SEC’s final decision deadline is currently set for October 10, but given the fast-moving nature of crypto regulation this year, approvals might come sooner.

Analysts are giving a 90% probability that these ETFs will be approved, particularly in light of a more crypto-friendly regulatory tone emerging in Washington. If cleared, this could introduce mainstream investors to Solana in the same way that spot Bitcoin ETFs opened up access earlier in 2024.

GameStop’s Bitcoin Investment Strategy Faces Market Skepticism

Despite raising $450 million—potentially for Bitcoin—GameStop’s stock performance shows that investors want more than just crypto headlines.

GameStop recently raised an additional $450 million through a private convertible note offering. Although the company hasn’t confirmed it will buy Bitcoin, many suspect that’s the plan, given its previous moves into crypto treasury assets.

At current prices, GameStop could nearly double its reported holdings of 4,710 BTC if it used the entire $450 million. However, market reaction has been muted. The company’s stock (GME) dipped slightly following the filing and remains largely flat in weekly performance.

Crypto insiders suggest that simply holding Bitcoin doesn’t guarantee stock growth. Vincent Liu, CIO at Kronos Research, noted that companies need a transparent, long-term plan when adopting crypto. Without a clear use case or treasury strategy, investor interest may fade—no matter how large the investment.

HBAR Rebounds After Ceasefire: Is a Breakout to $0.164 on the Horizon?

HBAR is showing signs of a bullish comeback after rebounding from a 12-day low, driven in part by improved market sentiment following the Israel-Iran ceasefire.

Currently trading near under 50-day Simple Moving Average (SMA), breaking above 50-day SMA level could confirm a trend reversal and push prices toward the $0.209 resistance zone in coming days. However, if bullish pressure fades and support at $0.14 fails, the token may revisit the $0.13 level. For now, the bias remains cautiously optimistic as long as HBAR holds above key support thresholds.

Bit Digital Abandons Bitcoin Mining for Ethereum Staking Model

Bit Digital is making a major shift. Instead of mining Bitcoin, it’s focusing fully on Ethereum staking—and investors are reacting.

Bit Digital (BTBT) announced it will gradually shut down or sell its Bitcoin mining infrastructure and pivot entirely to Ethereum staking. The firm says its goal is to become a dedicated ETH staking and treasury platform.

This move follows Bit Digital’s earlier entry into ETH staking infrastructure in 2022. As of Q1 2025, the company holds 24,434 ETH and 417 BTC. If all BTC were converted at current rates, Bit Digital’s ETH stash would rise to over 42,000 tokens.

The company also disclosed plans to raise capital by selling its own shares and using the proceeds to increase ETH exposure. However, this pivot hasn’t been received well in the short term—shares dropped 4% on the day of the announcement and are now down almost 25% year-to-date.

Ethereum Attracts More Institutions as Treasury Use Expands

Ethereum is catching up to Bitcoin in institutional interest. From staking yields to treasury strategies, firms are getting more comfortable with ETH.

Ethereum is no longer just the “second choice” behind Bitcoin. More companies are building treasury reserves in ETH or pivoting toward staking-based revenue models.

A notable example is SharpLink Gaming, which bought $463 million worth of ETH on June 13 and added another $30 million a few days later. That makes it the largest publicly listed ETH holder to date. Other firms like Coinbase and Bit Digital round out the top three institutional ETH holders, according to Strategic ETH Reserve, a tracking service for companies with over 100 ETH.

Staking rewards offer an additional incentive for firms to move toward Ethereum. Unlike Bitcoin, which is mined, Ethereum allows holders to participate in validating transactions and earn passive income—an attractive feature for companies looking to build sustainable yield.

Citibank Sued for Allegedly Allowing $20 Million Crypto Scam to Proceed

A $20 million lawsuit against Citibank is raising questions about how banks monitor suspicious crypto transactions.

Michael Zidell, a victim of a crypto romance scam, has sued Citibank for allegedly ignoring red flags that allowed scammers to drain his accounts. Zidell claims he transferred over $20 million to fraudulent entities after being lured into a romance-based investment scheme via Facebook.

Of that amount, around $4 million was routed through Citibank accounts. The lawsuit alleges that Citibank failed to detect “obviously suspicious” transactions and didn’t properly investigate the accounts receiving the funds.

Victims are typically lured into fake relationships that eventually involve investment pitches—usually with fraudulent platforms or tokens.

The case highlights the increasing tension between traditional banks and the crypto ecosystem, especially as regulators look into who should be responsible when fraud occurs.

Final Thoughts – Latest Crypto News Today

From ETF filings to crypto treasuries and fraud lawsuits, the digital asset space is entering a new stage of maturity. As Solana ETFs await regulatory decisions, companies like GameStop and Bit Digital are actively shaping how institutional involvement in crypto evolves. At the same time, the rise in scams underscores the importance of responsible oversight and informed strategy.

Crypto is no longer just about buying coins—it’s about building trust, creating value, and staying accountable.

Latest Crypto News;

- Why US Crypto Stocks Surged?

- Crypto News: Bitcoin Rebounds, Coinbase MiCA license, OKX IPO

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market

- Solana, XRP, and Dogecoin ETFs

- Project 11 Raised $6M to Fix Flaw Behind Bitcoin’s Iron Wall

- Bitcoin Mining Moves to the U.S. as Trade War and Security Fears Grow

- Crypto News Flash: Metaplanet Surpasses Coinbase,

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs

- Paraguay Hack, Circle IPO Boom, and Hong Kong’s Chainlink CBDC Pilot

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO

- Bitcoin News: JPMorgan, MoonPay, and K-Wave Drive BTC Adoption