U.S. crypto-related stocks made noticeable gains, even as global headlines focused on a ceasefire between Iran and Israel. The sudden pause in conflict — appeared shaky from the start. Still, the market responded with optimism.

US Crypto Stocks Rise

The market’s reaction to geopolitical news is rarely straightforward. On Monday, Trump announced on social media that a ceasefire had been reached between Iran and Israel. He added, somewhat optimistically, that it would “go on forever.” Yet within hours, both countries reportedly launched missile attacks, casting immediate doubt on the agreement’s durability.

Despite the continued hostilities, investor confidence grew — especially in risk-on sectors like crypto.

These gains came even as former President Trump admitted that both nations might have violated the terms of the ceasefire. So, what explains the disconnect?

Geopolitical risk often pushes investors toward alternative assets. Bitcoin, long seen as a hedge against traditional market instability, often gains attention during global tensions. As institutional traders and retail investors repositioned, they likely saw an opportunity in crypto-linked stocks.

Coinbase and Robinhood Lead Gains

The rally wasn’t limited to miners or institutional-focused platforms. Robinhood (HOOD), a popular platform among retail investors, climbed 7.41%. A big reason? The company launched a 1% crypto deposit match promotion, starting the same day and running through July 7.

This move may have signaled two things:

Robinhood’s promotion not only drove stock interest, but likely boosted trading activity on the platform itself. Coinbase, already well-positioned as a publicly listed crypto exchange, also benefited from a rise in volume and sentiment. Even smaller firms rode the wave — showing how market optimism can extend beyond just Bitcoin.

However, not every firm saw gains. Circle (CRCL), the stablecoin issuer recently listed on public markets, fell by 15.49% on the day. Still, Circle remains up over 600% since its IPO earlier this month.

Bitcoin Mining Difficulty Set for Biggest Drop Since 2021

While equities were rising, miners got a different kind of good news: relief.

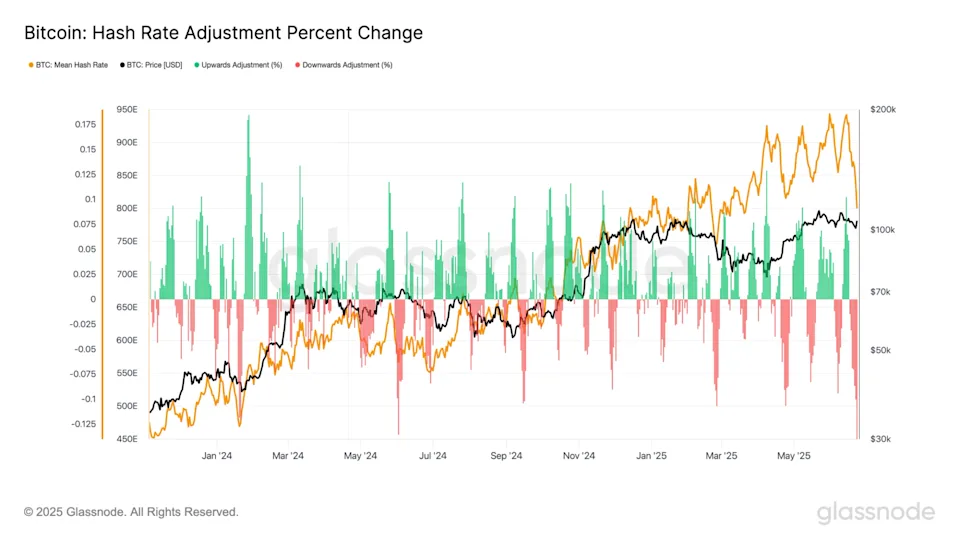

According to estimates, Bitcoin’s mining difficulty is set to drop by around 9% by June 29. That would mark the most significant reduction since China banned domestic mining operations in July 2021 — an event that temporarily wiped out much of the global hashrate.

So, what’s behind the drop?

The result? A lower hashrate, which triggers Bitcoin’s automatic difficulty adjustment. This recalibration allows remaining miners to earn more for the same work — a much-needed cushion for smaller players operating on tight margins.

Still, the benefit may not last long. As Bitcoin continues to hover above $100,000 and hashprice climbs near $53 (up from under $50), some expect previously idle mining rigs to come back online. If that happens, mining difficulty will climb again, pressuring margins once more.

Norway’s Green Minerals Bets $1.2 Billion on Bitcoin Treasury Strategy

In a surprising shift, Norwegian mineral firm Green Minerals announced plans to allocate up to $1.2 billion into Bitcoin as part of a new treasury strategy. The firm, which mines deep-sea minerals and is traded on Euronext Growth Oslo, said its first BTC purchases would begin within days.

Why the pivot?

The move comes at a time when more than 245 public companies now hold Bitcoin, collectively owning over $88 billion worth of the asset.

But the announcement had consequences. Green Minerals’ stock price plunged nearly 35% the same day. Some investors may be cautious due to Norway’s ongoing regulatory review. The government is reportedly considering a ban on new power-intensive crypto mining operations, citing better uses for national energy reserves.

Despite the drop, Green Minerals isn’t backing away. According to Rodahl, the strategy is aligned with the company’s long-term plans and infrastructure needs. For companies with long investment cycles, holding Bitcoin might offer diversification during uncertain financial periods.

What This All Means for Bitcoin’s Future and Crypto Market Growth

The recent developments across stock prices, mining dynamics, and corporate strategies point to one clear trend: crypto continues to evolve through complexity, not hype.

From a market structure perspective:

Looking forward, much will depend on:

Even with volatility and skepticism, crypto continues to attract capital, headlines, and innovation. While risk remains, the growing integration into traditional financial systems makes it harder to ignore. As more companies — both in and outside of finance — explore Bitcoin-backed strategies, the digital asset landscape is bound to become more interconnected.

Latest Crypto News;

- Crypto News: Bitcoin Rebounds, Coinbase MiCA license, OKX IPO

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market

- Solana, XRP, and Dogecoin ETFs

- Project 11 Raised $6M to Fix Flaw Behind Bitcoin’s Iron Wall

- Bitcoin Mining Moves to the U.S. as Trade War and Security Fears Grow

- Crypto News Flash: Metaplanet Surpasses Coinbase,

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs

- Paraguay Hack, Circle IPO Boom, and Hong Kong’s Chainlink CBDC Pilot

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO

- Bitcoin News: JPMorgan, MoonPay, and K-Wave Drive BTC Adoption

- Why Ethereum Is Attracting More Institutional Capital