The market was rocked by today’s crypto crash, which erased billions from market capitalization and raised concerns about a potential long-term decline. However, what or who is actually causing the chaos?

Crypto took a nose dive and turned red today

Let’s examine the main reasons, the participants, and the implications for future cryptocurrency investors.

In just a single day, the cryptocurrency market saw a huge outbreak; according to liquidation data, hundreds of thousands of traders were liquidated, and the market capitalization decreased.

Market traders have witnessed significant liquidations, with $1.7 billion lost in a single trading day, according to data released by CoinGlass on December 10.

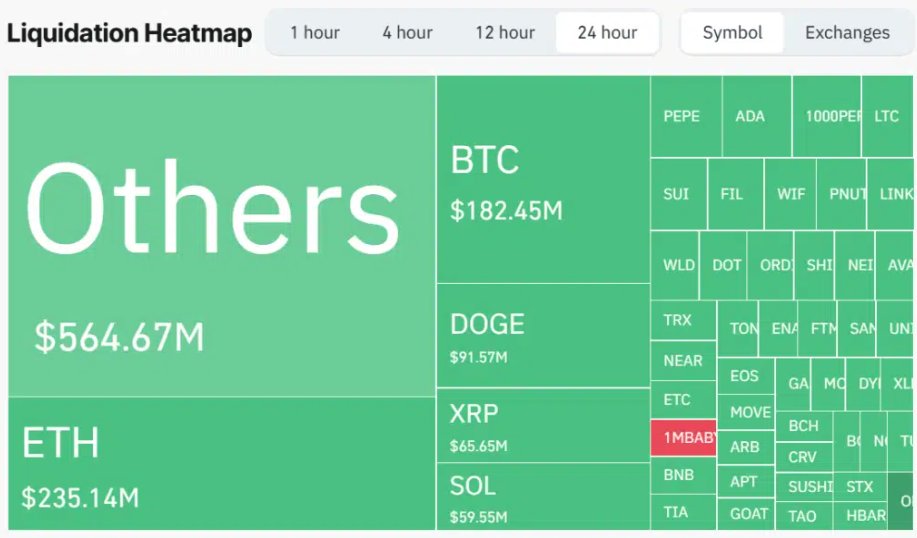

With $564 million in 24 hours, small-cap cryptocurrency is leading the liquidations. This is primarily due to long positions totaling $543 million and short positions totaling just $21 million. Today, half a million traders lost money.

Source: coinglass.com

Ethereum, with $235 million to $214 million longs and $21 million shorts, was the next token to undergo significant liquidation. At $3,686, the token fell 7% from its peak value for the day. With $140 million in longs and $42 million in shorts, the Bitcoin community has also witnessed $182 million in liquidation. In just one day, Bitcoin has dropped below the psychological $100,000 mark, trading at about $96,652.

Key factors for this massive crypto crash

Reason 1:

According to reports, major institutional players dumped a sizable amount of Ethereum and Bitcoin. Over $2 billion was taken out of major cryptocurrency wallets in a 24-hour period, according to data from Glassnode. Why It Matters: Organizations frequently influence the market. Their sell-offs have the potential to incite panic among individual investors, which could hasten the decline.

Reason 2:

The words spread like a fire in the news media. There have been renewed rumors of more stringent regulations aimed at stablecoins and decentralized exchanges. Such an act causes chaos in the market, and leads to uncertainty, which causes investors to sell their holdings.

Even though the crash today is concerning, it’s important to consider the wider picture. Don’t panic as there is a high chance of making a mistake. Read through the pattern shown in the charts. And most importantly, understand the fact crypto’s inherent volatility, cryptocurrency markets frequently offer the best opportunities for seasoned investors during times of intense fear.

Read more about how Ethereum has been performing, just a few days back!