The upcoming SUI token unlock schedules are drawing significant attention from traders. With large portions of tokens set to be released according to the official SUI token vesting schedule, the crypto market is bracing for increased SUI crypto supply.

Scheduled SUI coin release dates on May 31, June 30, and July 31, 2025, will collectively inject over $660 million worth of tokens into circulation. This surge in SUI token distribution could add selling pressure, especially from early investors and contributors seeking to realize profits.

As part of broader crypto token unlock events across the industry, SUI’s case stands out due to its structured unlock model and regular monthly emissions. For those following Sui news, these developments offer critical insights into tokenomics, potential market moves, and investor behavior.

Traders should monitor demand-side growth and ecosystem updates closely to adjust positions and risk accordingly.

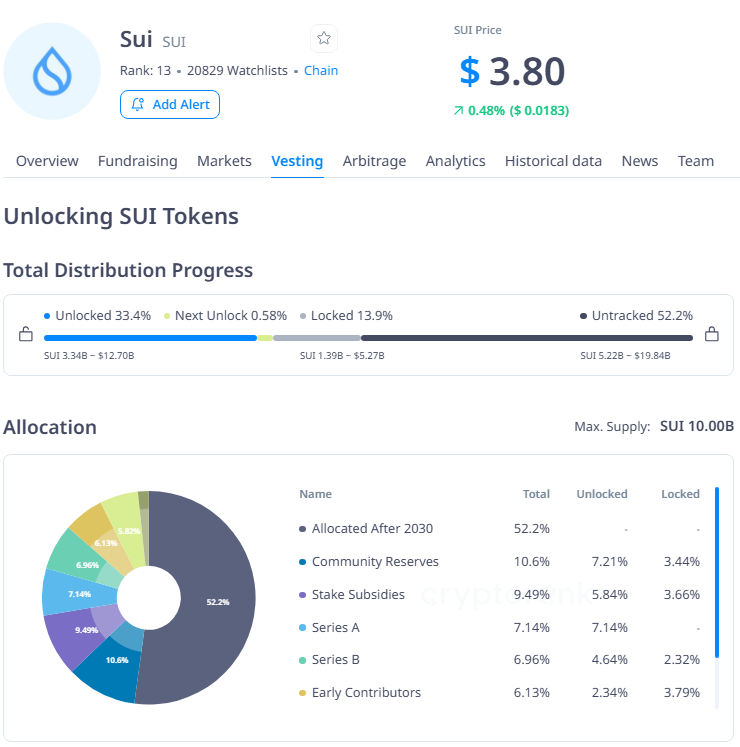

SUI Total Supply & Circulated Supply

- Total Supply: 10 billion SUI tokens

- Circulated Supply: 3.33 billion (33.3%)

What’s Happening with SUI Token Unlocking?

SUI is set to unlock a significant number of tokens over the next three months, starting May 31, 2025, with subsequent events on June 30, 2025 and July 31, 2025. Each of these unlocks represents approximately 0.57%–0.58% of the total max supply, translating to millions of tokens entering into circulation supply. These events can influence SUI crypto price prediction, market liquidity, and trader sentiment.

May 31, 2025 – SUI Token Unlock Schedule

- Tokens to be Unlocked: 58.35M SUI (0.58% of max supply)

- Estimated USD Value: ~$221.91M (1.75% of market cap)

- Key Allocations:

- Community Reserves: 12.63M

- Stake Subsidies: 14.35M

- Series B Investors: 19.32M

- Early Contributors: 9.98M

- Mysten Labs Treasury: 2.07M

Impact: This is a large unlock across multiple allocations, including early contributors and investors. Such events often introduce sell pressure and may trigger price corrections. Traders should be cautious of volatility.

June 30, 2025 – Continuation of SUI Token Unlock

- Tokens to be Unlocked: 58.35M SUI (0.58% of max supply)

- Estimated USD Value: ~$221.91M

Impact: This unlock is nearly identical in volume and structure to May’s. If May’s unlock impacts market sentiment or triggers sell-offs, this one could amplify it unless market absorption is strong.

July 31, 2025 – Slightly Smaller SUI Token Unlock

- Tokens to be Unlocked: 56.91M SUI (0.57% of max supply)

- Estimated USD Value: ~$216.46M

- Key Allocations:

- Community Reserves: 12.63M

- Stake Subsidies: 12.91M

- Additional rounds not shown

Impact: Although slightly smaller than May & June, the cumulative effect of three consecutive monthly unlocks could significantly affect SUI token price prediction and trading dynamics, especially if daily trading volume doesn’t scale with new supply.

Vesting Schedule Overview

The SUI vesting schedule shows that the majority of tokens will be released gradually over several years. This model is designed to prevent market flooding and promote steady growth:

- Community Programs and Rewards: Spread across several months

- Investor and Contributor Allocations: Released in structured monthly unlocks

- Treasury and Foundation Tokens: Unlocked gradually to support project development

Why This Matters for Investors

Understanding unlock events is crucial because:

- Increased supply = potential price drops (if demand doesn’t match)

- High unlock events often trigger sell-offs or market speculation

- Traders can use this data to plan entries/exits and manage risk

Smart investors track token unlocks to stay ahead of market moves. With SUI set to release hundreds of millions of tokens soon, volatility is expected.

Conclusion: SUI Token Unlock Schedule & Sui Price Prediction

The SUI token unlock schedule plays a major role in shaping its market dynamics. With several big releases on the horizon, traders and long-term holders must stay updated. Whether you’re investing for the long haul or trading short-term swings, understanding when and how tokens are released is critical to making informed decisions.

FAQs – SUI token unlock

Q1: What is the SUI token?

SUI is the native token of the Sui blockchain, used for staking, transaction fees, and governance.

Q2: What is the SUI token unlock schedule?

SUI unlocks are scheduled monthly, with major events coming on May 31, June 30, and July 31, 2025. Each event releases 0.57%–0.58% of the total max supply.

Q3: Why do SUI token unlocks affect price?

Unlocks increase the circulating supply, which can create selling pressure and lead to price fluctuations if demand doesn’t rise equally.

Q4: Is SUI a good long-term investment?

That depends on your investment goals. Keep an eye on the vesting schedule, project adoption, and overall market trends before making a decision. Short-term: potentially bearish due to sell pressure. Long-term: neutral to bullish if SUI adoption and use grow with ecosystem development.

Q5: Should traders be concerned about the SUI coin release dates?

Yes, these dates are important for traders as they often bring volatility.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Price predictions are speculative and based on current market data, technical indicators, and sentiment—accuracy is not guaranteed. Always do your own research and consult with a licensed financial advisor before making any investment decisions.

Latest Crypto News:

- Ripple Vs SEC Settlement Rejected

- XRP Price Prediction: Massive XRP Breakout Coming?

- XRP News Today: Ripple About to Shatter All-Time Highs?

- Shiba inu News Today

- Bitcoin Crashes Below $102K After Tariff Truce – Is the Bull Run at Risk?

- Pi Coin Skyrockets 40% Amid Buzz Over Major Announcement

- Shiba Inu (SHIB) Poised for 105% Surge

- Solana’s Meteoric Rise

- XRP Price Skyrockets — Here’s Why It’s Surging Fast

- 5 Shocking Reasons Why Ethereum Price Is Going Up

- What is Tether AI? How Tether is using AI

- Solana Gets $500M Investments

- 3 Ways to Reduce Gas Fees on Ethereum