Bitcoin has often been described as volatile, unpredictable, or even speculative. But the digital asset’s journey into mainstream finance is accelerating as some of the world’s biggest financial institutions, political figures, and regulators take meaningful steps toward long-term adoption. From BlackRock’s spot Bitcoin ETF returning to a technical buy zone, to a Trump-backed Bitcoin mining firm raising hundreds of millions, to Circle pushing for a U.S. bank charter, and Germany’s most conservative banking group launching crypto trading — the writing on the wall is becoming clearer. Crypto is no longer a side project or fringe movement. It’s becoming part of the structure of global finance.

What Makes IBIT the Most Watched Bitcoin ETF Right Now?

When BlackRock launched the iShares Bitcoin Trust ETF (IBIT) in January 2024, it became the first spot Bitcoin ETF in the U.S. Spot ETFs directly hold the underlying asset — in this case, Bitcoin — and reflect its actual market price. For investors who want exposure to Bitcoin without handling wallets or private keys, IBIT offers a clean, regulated route through their brokerage account.

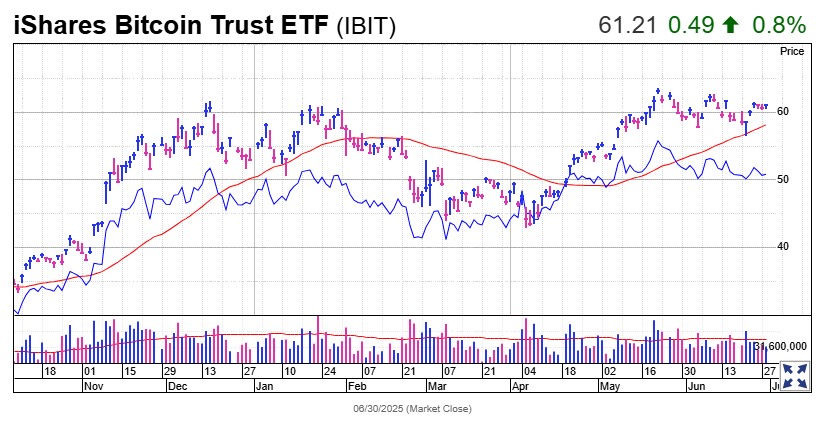

Recently, IBIT has shown signs of strength. After an initial breakout above the $61.75 level in May, shares pulled back but quickly found support around the 50-day moving average on June 23. The ETF then regained its 21-day exponential moving average, suggesting that buyers are stepping back in. Today, IBIT trades in the $60 to $61 range, edging closer to its previous buy zone, which stretches from $61.75 to $64.84.

This technical resilience has put IBIT on the radar of institutional investors and analysts alike. Its inclusion on Investor’s Business Daily’s Leaderboard — alongside high-growth names like Nvidia and Netflix — adds further credibility. Beyond price action, the ETF represents something more important: the maturing infrastructure of Bitcoin investment. By giving institutions a familiar structure to gain exposure, funds like IBIT are making it easier for traditional capital to flow into digital assets.

Trump-Backed Bitcoin Mining (Crypto Market News & Updates Jul 1, 2025)

While ETFs like IBIT offer passive exposure to Bitcoin’s price, mining companies remain essential to the operation of the Bitcoin network. Recently, a new mining firm called American Bitcoin made headlines by raising $220 million in a private funding round. What makes this especially notable is its political backing — the firm is supported by Eric Trump and Donald Trump Jr., aligning closely with the former president’s pro-Bitcoin agenda.

According to filings from Hut 8, which owns a significant stake in the company, American Bitcoin raised funds by selling over 11 million new shares. Approximately $10 million worth of shares were purchased using Bitcoin instead of dollars, with an exchange rate set at $104,000 per Bitcoin — well above market price at the time. This shows the participants are not just investing in the business but are making a strong directional bet on the future value of Bitcoin itself.

The funds raised will be used to accumulate Bitcoin and acquire mining hardware. The company plans to go public in the second half of 2025 through a merger with Gryphon Digital Mining, and will list on the Nasdaq under the ticker symbol ABTC. American Bitcoin’s strategic focus isn’t just about profitability. It aligns with a growing political message: to keep Bitcoin mining capabilities within the United States and establish national leadership in the crypto industry.

Circle’s Bank Charter Application: A Big Step for USDC and Stablecoin Regulation

Stablecoins like USDC have played a critical role in crypto adoption, especially as on-ramps for users and institutions that want price stability within blockchain ecosystems. Now, Circle — the company behind USDC — is taking a significant step toward integrating with the U.S. financial system. The company has officially applied for a national trust bank charter with the Office of the Comptroller of the Currency.

If approved, Circle will create a new entity called First National Digital Currency Bank, N.A. This federally chartered trust bank will allow Circle to offer more services, including institutional custody, and operate under direct federal supervision. Importantly, the move positions Circle to comply with the recently passed GENIUS Act, which establishes legal clarity for stablecoin issuers operating within the U.S.

Circle’s leadership says this is part of a larger mission to bring transparency and resilience to the financial system by building it on digital infrastructure. By operating under a national charter, Circle would join Anchorage Digital as one of only two crypto firms in the U.S. with such regulatory status.

The timing is also crucial. Circle’s application follows a highly successful IPO and a massive rally in its stock price, which climbed more than 480 percent in June. Investors and regulators are clearly watching closely. Circle’s approach to stablecoin regulation appears to be proactive rather than reactive — a calculated effort to meet upcoming legal standards head-on while expanding USDC’s use across both crypto-native and traditional financial ecosystems.

Germany’s Largest Bank Group Prepares to Launch Crypto Trading by 2026

In Europe, the pivot toward regulated crypto access is taking shape in one of the most conservative banking systems in the world. Sparkassen-Finanzgruppe, Germany’s largest banking group with over 50 million customers and €2.5 trillion in assets, has announced plans to introduce in-app crypto trading by the summer of 2026. This is a significant departure from the group’s previous position. In 2015, the same institution blocked crypto purchases and warned customers against digital assets.

Now, Sparkassen is embracing crypto, albeit cautiously. The group has tapped Dekabank, one of its subsidiaries already familiar with crypto custody and infrastructure, to manage the new trading service. The offering will be integrated directly into the Sparkasse app, making it easy for everyday Germans to buy, sell, and possibly hold crypto assets in a regulated environment.

Although the group still emphasizes that cryptocurrencies are speculative and warns of the risk of total loss, this move reflects changing customer demand and a regulatory landscape that is beginning to accommodate digital assets. Under the European Union’s MiCA (Markets in Crypto-Assets) regulatory framework — which became enforceable in December — such services are now legally viable across the bloc.

Final Thoughts (Crypto Market News & Updates Jul 1, 2025)

The signals from financial giants, political figures, regulators, and European banks are aligning around a simple idea: crypto is becoming too important to ignore. It is moving into the mainstream not because of hype, but because of usability, infrastructure, and long-term strategic value.

The return of IBIT to technical support levels, the Trump family’s direct involvement in Bitcoin infrastructure, Circle’s federal charter ambitions, and Sparkassen’s massive retail rollout each reflect a different dimension of this shift. What binds them together is a shared recognition that the next phase of finance will likely include — and in some cases depend on — blockchain-based assets.

For investors, the message is clear. Crypto is no longer just a speculative corner of the internet. It’s steadily becoming a regulated, structured, and global financial instrument.

Latest Crypto News;

- Crypto Market News & Updates Jun 30, 2025

- Robinhood Launches Micro Bitcoin, Solana, and XRP Futures for U.S. Traders

- Bitcoin Hits $40B in Derivative Market as Corporations Rush Into Crypto Market

- Why US Crypto Stocks Surged?

- Crypto News: Bitcoin Rebounds, Coinbase MiCA license, OKX IPO

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market

- Solana, XRP, and Dogecoin ETFs

- Project 11 Raised $6M to Fix Flaw Behind Bitcoin’s Iron Wall

- Bitcoin Mining Moves to the U.S. as Trade War and Security Fears Grow

- Crypto News Flash: Metaplanet Surpasses Coinbase,

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs