Bitcoin has slipped below the $100,000 and rebound quickly amid geopolitical unrest and technical weaknesses. Analysts warn of potential downside targets around $93,000 to $74,000, fueled by over $700 million in market liquidations. Simultaneously, phishing attacks on crypto news sites have exposed major security flaws.

On the regulatory front, Coinbase secured MiCA license, while OKX eyes a U.S. IPO. Cardone Capital’s $100M Bitcoin purchase signals growing institutional interest. Long-term confidence in crypto adoption and regulation remains cautiously optimistic.

Bitcoin Price Rebounds — How Low Can BTC Go?

The latest data suggests that this may not be the bottom. Analysts point to technical indicators and market sentiment hinting at even lower targets. With Bitcoin deviating 12% from its all-time high of $112,000, the next levels to watch are $97,000 and potentially $93,000.

The recent dip has coincided with increased volatility and liquidation events across the market. Chart watchers are closely eyeing the rounded top formation forming on higher timeframes — a bearish signal that has historically preceded deeper corrections. Traders are already reacting to liquidation clusters forming around the $97,000 zone, suggesting this could be the next likely stop.

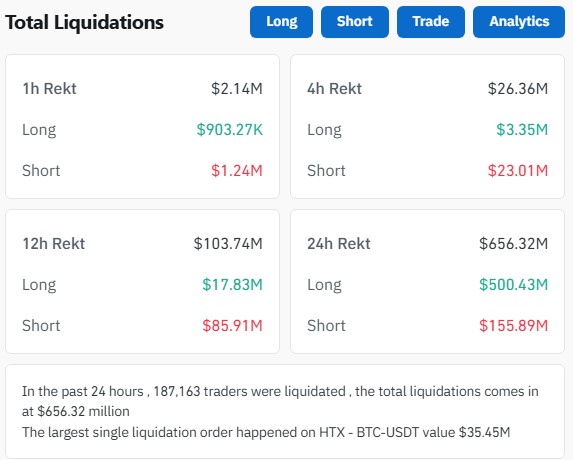

Mass Liquidations of Over $656M Wiped in 24 Hours

According to data from CoinGlass, more than $672 million in crypto positions were liquidated within 24 hours of the drop. Of that, Bitcoin accounted for $238 million in long liquidations alone. These events happen when traders using leverage are forced out of their positions automatically — adding downward pressure to the price.

Phishing Attacks on Crypto News Giants Raise Alarm

Cointelegraph confirmed its website was hacked via a front-end exploit used to serve phishing pop-ups. Users were tricked into connecting wallets for a fake token airdrop, with claims of over $5,000 in free crypto rewards.

This wasn’t an isolated event. CoinMarketCap faced a nearly identical exploit just days earlier. Both incidents show how attackers are targeting trusted media outlets to execute high-level scams. While the crypto industry has matured in many ways, the security layer — especially around information sources — remains vulnerable.

Crypto users should avoid interacting with pop-ups and always verify URLs, especially during high market volatility when phishing scams tend to surge. As trust in digital systems gets tested, these events can have an indirect effect on price confidence too.

Coinbase Secures MiCA License

Away from the market panic, Coinbase achieved a significant milestone by securing a MiCA license through Luxembourg. This regulatory green light allows it to offer crypto services across all 27 European Union countries. With regulation in the EU becoming more structured, Coinbase is positioning itself for long-term growth.

The MiCA framework, which became active in June 2023, simplifies licensing for crypto platforms. Firms licensed in one EU country can legally operate in others. Coinbase’s decision to choose Luxembourg was likely influenced by its progressive approach to digital asset laws and regulatory consistency.

This move could lead to an influx of institutional and retail investors within the EU. For the broader market, it signals that regulatory clarity is gradually improving, and big players are adjusting their operations to comply rather than resist.

OKX Eyes U.S. IPO Following Compliance Push

Another player looking to expand its global reach is OKX. The exchange, which previously faced regulatory scrutiny in the U.S., is now considering an initial public offering in the country. The move follows its $500 million settlement with the Department of Justice earlier this year and a decision to build out a U.S. team.

While no IPO filing has been made public yet, insiders suggest that OKX would likely go public in the U.S. if the conditions remain favorable. The decision would follow the footsteps of Circle, which recently went public and raised over a billion dollars.

An IPO would not only boost OKX’s visibility but also reinforce investor confidence in the platform. The exchange is clearly pivoting toward compliance and long-term legitimacy — something many crypto projects are now being forced to do if they want to scale in Western markets.

Cardone Capital Buys 1,000 BTC — Real Estate Meets Crypto

In a bold treasury move, Grant Cardone’s Cardone Capital has purchased 1,000 Bitcoin — valued at over $100 million. The real estate investment firm is combining traditional property assets with digital ones, creating what they call a hybrid treasury strategy.

Cardone said the goal is to use real estate cash flow to acquire more Bitcoin, allowing the firm to hold two strong-performing asset classes at once. This isn’t just a diversification play — it’s a signal that some institutional investors view Bitcoin as a reliable store of value.

Cardone Capital also launched a fund that includes a Miami River residential property and $15 million in Bitcoin. This experimental blend of assets could inspire similar strategies among other real estate firms, especially those seeking to modernize portfolios and attract younger, crypto-savvy investors.

Conclusion: What Lies Ahead for Bitcoin and Crypto Markets

Despite the drop, the long-term fundamentals of Bitcoin remain intact. If support zones hold and regulatory clarity continues to emerge, we may look back at these levels as buying opportunities, not the start of a prolonged decline. Still, for now, caution remains the name of the game.

Latest Crypto News;

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market

- Solana, XRP, and Dogecoin ETFs

- Project 11 Raised $6M to Fix Flaw Behind Bitcoin’s Iron Wall

- Bitcoin Mining Moves to the U.S. as Trade War and Security Fears Grow

- Crypto News Flash: Metaplanet Surpasses Coinbase,

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs

- Paraguay Hack, Circle IPO Boom, and Hong Kong’s Chainlink CBDC Pilot

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO

- Bitcoin News: JPMorgan, MoonPay, and K-Wave Drive BTC Adoption

- Why Ethereum Is Attracting More Institutional Capital

- Bitcoin Hits New All-Time High: What’s Next?

- How High Can Bitcoin Go in 2025?