This week’s Bitcoin news highlights a powerful mix of institutional adoption, political involvement, and global tension. Trump Media secured SEC approval to buy Bitcoin with $2.3 billion in capital, signaling deeper political entry into crypto markets. Despite the Israel-Iran conflict, Bitcoin held strong above $105K, supported by $1.3 billion in ETF inflows. Meanwhile, Michael Saylor dismissed quantum computing threats to BTC, asserting it poses a bigger risk to traditional finance first. Together, these developments suggest Bitcoin’s growing maturity as a financial asset amid complex global dynamics.

Key Takeaways:

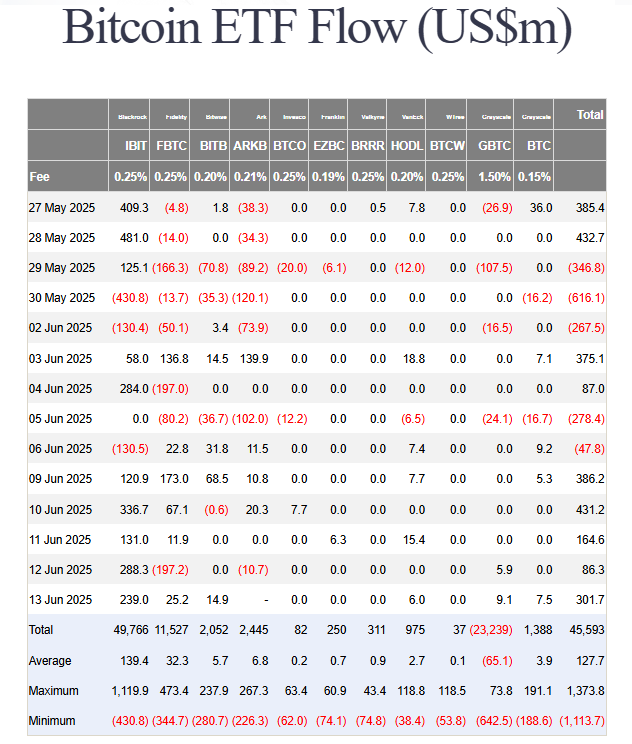

Bitcoin Spot ETF Inflows Hit $1.3B Amid Middle East Tensions

Despite rising geopolitical fears over the renewed Israel-Iran conflict, Bitcoin’s price has remained surprisingly stable. Last week, Bitcoin hovered around the $105,000 level, only dropping slightly from its recent peak near $111,970.

One reason? Spot Bitcoin ETFs.

According to data from Farside Investors, Bitcoin ETFs attracted a total of $1.37 billion in net inflows across five consecutive trading days. Institutions are piling in, ignoring short-term volatility in favor of long-term conviction

Even after reports of Israeli airstrikes and retaliatory missile attacks from Iran, investors stayed bullish. The Crypto Fear & Greed Index, which tracks investor sentiment, remained in the “Greed” zone with a score of 60—a clear sign that buyers still dominate the market.

“Bitcoin is relentless,” wrote crypto investor Anthony Pompliano, responding to market behavior amid the conflict.

The fact that capital keeps flowing into Bitcoin ETFs despite geopolitical risk signals something important: Bitcoin is being seen more and more as a macro hedge, like gold—especially in uncertain times.

Bitcoin Holds Strong as the U.S. Dollar Weakens

Another key piece of the puzzle is the U.S. Dollar Index (DXY). As the dollar continues to show weakness, especially after softer-than-expected inflation data, Bitcoin has benefited.

Traditionally, Bitcoin and the dollar have an inverse relationship. When the dollar slips, Bitcoin often rallies. This is exactly what played out this past week.

With the Fed signaling fewer interest rate hikes for the year and inflation easing, investors are rotating out of dollars and into assets with fixed supply—Bitcoin being the obvious choice.

Could Strait of Hormuz Instability Shake Bitcoin’s Momentum?

The Strait of Hormuz, a narrow waterway between Oman and Iran, is responsible for transporting about 20% of the world’s oil. Any disruption here has ripple effects on global markets, from energy prices to currencies—and yes, even crypto.

Following explosions in Tehran and missile exchanges between Iran and Israel, fears of a broader regional war intensified. While oil prices jumped, Bitcoin barely flinched.

So why didn’t BTC crash like it did after similar escalations in 2024?

It appears the market is evolving. Crypto investors now weigh geopolitical risks differently. Instead of viewing Bitcoin as a risky asset, many now consider it a digital safe haven during global instability.

However, the longer the tension lingers—especially near vital chokepoints like Hormuz—the greater the potential shock to all markets, including Bitcoin.

Quantum Threat to Bitcoin: Why “Q-Day” Still Demands Urgent Upgrades

In a June 6 interview on CNBC’s Squawk Box, Michael Saylor, chairman of Strategy (formerly MicroStrategy), made headlines by addressing the quantum computing risk to Bitcoin.

His take?

“Quantum computers, if they worked, would destroy Google, Microsoft, the U.S. government, and the banking system before they get to Bitcoin.”

That’s a bold claim, but it has a factual foundation.

What’s the Concern?

Quantum computers are theorized to crack encryption that would take traditional computers millions of years—in just seconds. This raises alarms about digital wallets, cryptographic keys, and secure blockchains like Bitcoin.

However, Saylor argues that legacy systems, including government databases and big tech, are far more vulnerable than Bitcoin due to older or weaker encryption standards.

In his view, the quantum threat is real but not immediate.

Why Bitcoin Might Survive the Quantum Era

Bitcoin relies on ECDSA (Elliptic Curve Digital Signature Algorithm) to secure wallets and verify transactions. In theory, quantum computers could break this if they ever reached large enough scale and stability.

But we’re not there yet.

According to Nvidia CEO Jensen Huang, who spoke at CES 2025, a major breakthrough in quantum computing may still be 15–30 years away.

In the meantime, Bitcoin developers and cryptographers are already working on quantum-resistant upgrades. These include post-quantum cryptographic methods that could be integrated into Bitcoin Core in the coming years if needed.

That’s part of what makes Bitcoin unique—its open-source, upgradeable nature. Unlike traditional banking systems or legacy software, Bitcoin doesn’t rely on a central authority to patch vulnerabilities.

During a June 6 appearance on CNBC’s Squawk Box, Michael Saylor stated that if quantum computers were ever able to crack cryptographic security, they would “destroy Google, Microsoft, the U.S. government, and the banking system” well before threatening Bitcoin.

He emphasized that Bitcoin’s blockchain is more secure than conventional databases, making legacy systems more vulnerable to quantum attacks.

SEC Clears Trump Media’s $2.3 Billion Bitcoin Treasury Plan

In one of the most surprising regulatory moves this year, the U.S. Securities and Exchange Commission (SEC) just approved a major filing by Trump Media & Technology Group (TMTG)—the company behind Truth Social and now the ticker DJT on Nasdaq.

Here’s the big news: The SEC declared effective Trump Media’s Form S-3, which unlocks $2.3 billion in capital that the company can now use to purchase Bitcoin.

The filing also includes a $12 billion “universal shelf”, giving Trump Media the ability to issue more stock, debt, or warrants at any time.

So what does this mean for Bitcoin?

It means a publicly traded company with close ties to former U.S. President Donald Trump could begin massive discretionary purchases of Bitcoin—similar to how MicroStrategy operates.

While Trump Media hasn’t said exactly how much BTC it will buy or when, the company wrote in its prospectus:

“TMTG will acquire its Bitcoin and Bitcoin-related holdings in the amounts and on the timeline it deems optimal.”

This move puts Trump Media on a similar path as major corporate Bitcoin holders like Tesla and Strategy.

DRW and Institutional Backers Push Trump Media’s Bitcoin Strategy Forward

It’s worth noting that Trump Media didn’t raise these billions in a vacuum.

A key backer is DRW, a major Chicago-based trading firm led by billionaire Don Wilson. DRW and nearly 50 institutional investors participated in the PIPE (private investment in public equity) deal that raised the $2.3 billion.

This isn’t just a political gimmick. It’s a strategic financial maneuver, and institutional players are behind it.

In January 2025, Trump Media also launched Truth.fi, a new fintech brand targeting “America First” crypto and financial products. The brand could roll out crypto services or even digital wallets tied to political and financial values.

This adds an entirely new dimension to the intersection of crypto and U.S. politics—especially as we head into the 2024 election cycle.

Bitcoin Fear & Greed Index: A Barometer of Investor Sentiment

The Bitcoin Fear & Greed Index, a tool often used by traders to gauge market psychology, held in the Neutral range even after Israel’s airstrikes on Iran. Having said that bitcoin price chart, previous history still showing bullishness and investors are eyeing on above $125k level.

Final Thoughts: A Bullish Chain Reaction for Bitcoin

When you connect all these dots—Trump’s SEC-approved Bitcoin strategy, ETF inflows, quantum concerns, and geopolitical strength—a clear pattern emerges.

Bitcoin is no longer just a speculative asset. It’s becoming a permanent pillar of global finance.

Corporations want it. Institutions are buying it. Even political figures are aligning with it.

Sure, risks remain. Quantum computing, war, regulation—all of these are factors. But Bitcoin has shown time and again that it’s resilient, adaptable, and here to stay.

For now, the $100,000 psychological level is holding strong. The next target? All eyes are back on the $112,000 all-time high—and beyond.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making investment decisions.

Latest Crypto News;

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs

- Paraguay Hack, Circle IPO Boom, and Hong Kong’s Chainlink CBDC Pilot

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO

- Bitcoin News: JPMorgan, MoonPay, and K-Wave Drive BTC Adoption

- Why Ethereum Is Attracting More Institutional Capital

- Bitcoin Hits New All-Time High: What’s Next?

- How High Can Bitcoin Go in 2025?

- Ripple to Unlock 1 Billion XRP in June 2025

- Ripple joins Hands With Zand Bank and Mamo

- Is XRP Worth Buying? Can XRP Reach $10?

- Ripple Vs SEC Settlement Rejected

- XRP Price Prediction: Massive XRP Breakout Coming?