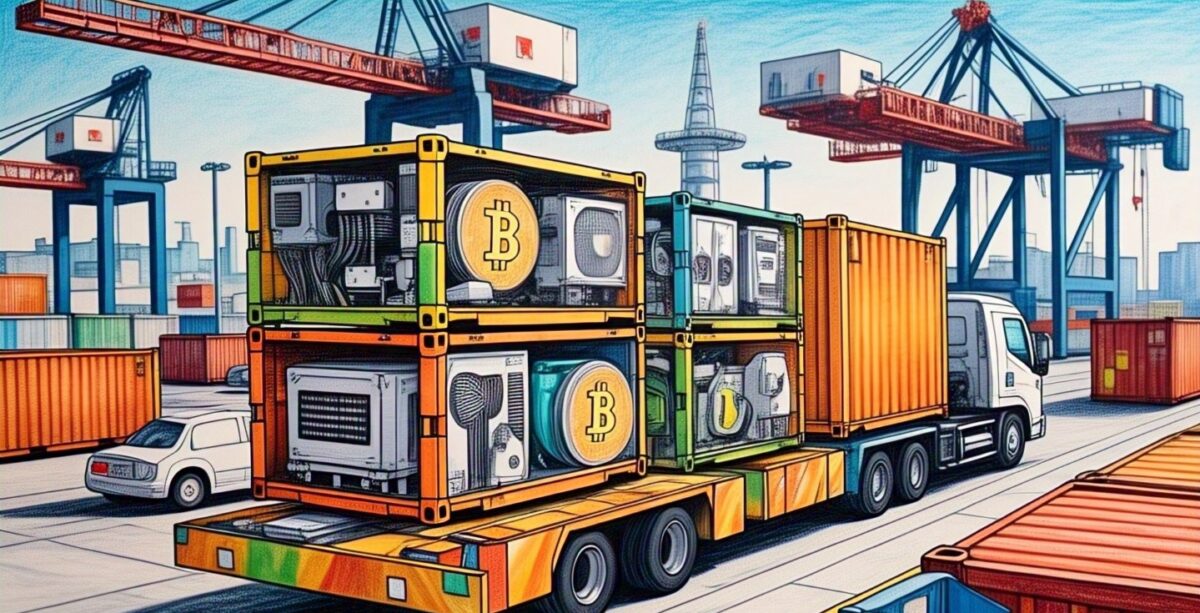

As the United States tightens tariffs on Chinese imports and raises national security alarms, three Chinese giants that dominate the bitcoin mining machine market are moving their production to America. Meanwhile, the Federal Reserve’s steady interest rates and rising inflation are reshaping investment behaviour, pushing bitcoin into the spotlight once again.

Bitcoin Mining Hardware Moves to the U.S. Amid U.S.-China Trade Tensions

The U.S.-China trade war is more than just political headlines—it’s forcing strategic shifts in how and where bitcoin mining hardware is made. Chinese firms like Bitmain, Canaan, and MicroBT are moving production to the U.S. to avoid heavy tariffs, altering the crypto supply chain.

For years, China dominated the entire bitcoin value chain—from manufacturing mining rigs to running mining farms and exchanges. But after China’s 2021 crypto ban, only the hardware side remained intact. Bitmain, Canaan, and MicroBT—together producing over 90% of the world’s mining hardware—continued to lead the global market.

Now, U.S. tariffs on Chinese technology are pushing these companies to build factories in America. Bitmain launched U.S. operations shortly after Donald Trump’s 2024 election win. Canaan began trial production, and MicroBT has confirmed its “localization strategy” to protect its market share in North America.

Why? The U.S. has slapped a 10% baseline tariff and an extra 20% specifically on Chinese tech imports, including mining rigs. Manufacturing locally helps Chinese firms avoid these costs—but it’s not without complications.

National Security Concerns Over Chinese Crypto Hardware Spark U.S. Action

Security fears and supply chain vulnerabilities are leading the U.S. to rethink its reliance on Chinese-made bitcoin infrastructure. Even with local operations, Chinese firms face suspicion, making the path forward complex.

Industry experts warn that over 90% of bitcoin mining hardware still originates from China—even though over 30% of actual mining now happens in North America. That imbalance has caught the attention of both policymakers and U.S.-based crypto firms.

Auradine, backed by the top U.S. bitcoin miner MARA Holdings, is lobbying to curb imports of Chinese mining rigs. Sanjay Gupta, its chief strategy officer, voiced concerns over “hundreds of thousands of Chinese mining machines plugged into the U.S. electrical grid,” calling them a national security threat.

Adding to the tension, Bitmain’s AI subsidiary, Sophgo, was blacklisted by the U.S. over similar concerns. Though companies like Canaan argue that mining rigs pose no threat unless used maliciously, the stigma of “foreign control” persists.

Even with U.S. plants, Chinese firms face headwinds. Their strategic move to set up operations in America isn’t just about tariffs—it’s about survival. Tariff wars, localization pressure, and tightening security scrutiny are forcing these companies to evolve quickly.

Tariffs, Inflation, and a Shift Toward U.S. Crypto Sovereignty

With inflation remaining stubborn and the Federal Reserve keeping rates steady, bitcoin is increasingly viewed as a hedge. At the same time, U.S. regulators are cracking down on fraud and taking control of crypto infrastructure.

As the hardware side of crypto decentralizes from China, macroeconomic forces are shaping investor behavior. The U.S. Federal Reserve recently left interest rates steady at 4.25%–4.50%, citing concerns over slower GDP growth and persistent inflation—hallmarks of stagflation.

This environment, according to analysts like David Hernandez of 21Shares, may favor bitcoin. “New capital will inevitably search for assets that offer a store of value… and that search leads many directly to BTC,” Hernandez said. Bitcoin’s fixed supply, global nature, and independence from U.S. monetary policy give it unique appeal.

But the crypto market also faces risks.

Just days ago, the U.S. Justice Department seized over $225 million in cryptocurrency linked to fraudulent investment schemes. The FBI reported over $9.3 billion in crypto fraud losses in 2024 alone—a 66% increase over the previous year. With over 41,000 fraud complaints tied to crypto investments, the crackdown is growing.

While bitcoin becomes more attractive as a hedge, regulation is becoming more aggressive. It’s a dual-track approach: encourage innovation and crypto adoption, but restrict bad actors and foreign dominance.

This aligns with President Trump’s “crypto-first” policy pitch. His administration is supporting projects like American Bitcoin (with son Eric Trump and Hut 8) to create a national bitcoin reserve—essentially a state-backed stash of mined BTC to offset external dependencies.

Bitcoin Infrastructure and Policy

What we’re witnessing is not just a trade story or a tech shift—it’s the rewriting of the global crypto map. Chinese mining giants are no longer safe in China. They’re moving to the U.S., adapting to new rules. Meanwhile, inflation and interest rates are pulling more institutional and retail investors toward bitcoin as a hedge.

At the same time, fraud crackdowns are bringing much-needed regulatory maturity to the space. As global and domestic pressures build, the U.S. is positioning itself to control more of the crypto infrastructure—while keeping one wary eye on China.

The landscape is still evolving. But one thing is clear: the future of bitcoin, both as an asset and as an industry, will be shaped as much by politics and economics as it is by code and computation.

Latest Crypto News;

- Crypto News Flash: Metaplanet Surpasses Coinbase, Strategy Hints at More Bitcoin Buys

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs

- Paraguay Hack, Circle IPO Boom, and Hong Kong’s Chainlink CBDC Pilot

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO

- Bitcoin News: JPMorgan, MoonPay, and K-Wave Drive BTC Adoption

- Why Ethereum Is Attracting More Institutional Capital

- Bitcoin Hits New All-Time High: What’s Next?

- How High Can Bitcoin Go in 2025?

- Ripple to Unlock 1 Billion XRP in June 2025

- Ripple joins Hands With Zand Bank and Mamo

- Is XRP Worth Buying? Can XRP Reach $10?

- Ripple Vs SEC Settlement Rejected