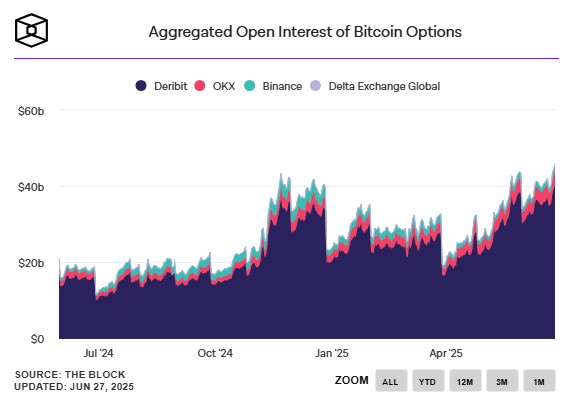

As Bitcoin clings to the $106,000 range, Deribit’s bitcoin options open interest smashes past $40 billion. A deeper transformation is taking place across derivatives markets, corporate treasuries, and regulatory conversations surrounding stablecoins. This isn’t just about price action—it’s about how deeply embedded digital assets are becoming in mainstream finance.

Bitcoin Options Open Interest Surges Past $40 Billion on Deribit

Deribit, the dominant crypto derivatives exchange, recently reported a historic milestone: over $40 billion in open interest for Bitcoin options. This figure represents nearly 90% of total market share across all trading platforms.

More than 139,000 BTC contracts expired on June 27, valued at approximately $15 billion in notional terms. The put-call ratio closed at 0.75, signaling a bullish lean among traders. The maximum pain point—where most options expire worthless—was near $102,000.

These numbers matter because they show how institutional players are structuring their exposure. Derivatives like options allow large holders to hedge risks or bet on volatility, making this segment a critical indicator of market confidence.

Deribit’s explosive open interest shows that institutional bets on Bitcoin are not only growing but becoming central to price discovery.

ETH Options Expiry Highlights Growing Derivatives Demand

It wasn’t just Bitcoin in focus. Ethereum saw 939,000 contracts expire on Deribit—a total notional value of $2.29 billion. The ETH put-call ratio came in at 0.52, with the pain point around $2,200.

While ETH’s price slipped, these figures suggest a healthy appetite for altcoin derivatives. It also reveals that traders are using ETH options to manage downside risk while maintaining upside exposure.

Ethereum‘s contract expiry volume underscores its role as more than a smart contract platform—it’s now a key asset for professional hedging.

Corporate Bitcoin Buying Accelerates Under Trump-Era Crypto Policies

With Trump back in office and declaring the U.S. the “crypto capital,” businesses are jumping into Bitcoin. Over 60 publicly listed firms now hold a combined 673,000 BTC worth more than $75 billion. Trump Media, for example, plans to spend up to $2.5 billion on BTC.

This rush into digital reserves is triggering concern from regulators. Lawmakers like Sen. Elizabeth Warren warn that these crypto-heavy balance sheets could amplify future downturns.

Corporate treasury strategies are changing fast, but reliance on volatile assets like Bitcoin raises systemic risk concerns among policymakers.

Bakkt Prepares $1 Billion Securities Sale to Fund Bitcoin Treasury Move

Bakkt Holdings has filed to sell up to $1 billion in securities to support potential Bitcoin purchases. Backed by Intercontinental Exchange, Bakkt recently updated its investment policy to allow for digital assets.

The new S-3 filing doesn’t guarantee a purchase but gives Bakkt flexibility to act when market conditions are favorable. It reflects how treasury management is evolving beyond traditional assets.

Bakkt’s move signals that even conservative financial platforms are exploring crypto as a long-term asset class.

Coinbase Rides Circle Surge Amid Growing Stablecoin Revenue Opportunities

As Circle’s IPO draws investor attention, Coinbase is emerging as a secondary beneficiary. The exchange receives half the interest from USDC reserves and all the yield from coins stored directly on its platform.

With over $250 billion worth of stablecoins in circulation, Coinbase is in a strong position to leverage this trend. Stablecoins may not yet dominate daily purchases, but they are becoming a vital part of crypto infrastructure.

Coinbase‘s business model shows how centralized exchanges are profiting from stablecoins without needing to issue them directly.

Final Thoughts

Crypto markets are evolving fast—not just in how assets trade, but in how they’re viewed by companies, regulators, and institutional investors. Derivatives volumes, stablecoin adoption, and corporate balance sheets are all pointing to a more integrated financial future. But with greater exposure comes greater responsibility. The choices made today could define the next cycle.

Latest Crypto News;

- Why US Crypto Stocks Surged?

- Crypto News: Bitcoin Rebounds, Coinbase MiCA license, OKX IPO

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market

- Solana, XRP, and Dogecoin ETFs

- Project 11 Raised $6M to Fix Flaw Behind Bitcoin’s Iron Wall

- Bitcoin Mining Moves to the U.S. as Trade War and Security Fears Grow

- Crypto News Flash: Metaplanet Surpasses Coinbase,

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs

- Paraguay Hack, Circle IPO Boom, and Hong Kong’s Chainlink CBDC Pilot

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO