Bitcoin ETFs saw a strong $1.02 billion inflow last week, reflecting rising institutional interest. BlackRock’s IBIT led the way, while growing regulatory clarity, including the GENIUS Act, is strengthening market confidence. Corporates like DigiAsia and The Blockchain Group are advancing long-term Bitcoin treasury strategies. Strategy, has acquired an additional 245 BTC in last 24 hours.

Strategy Increases Bitcoin Holdings with $26 Million Purchase

Michael Saylor’s firm, Strategy, has acquired an additional 245 BTC for roughly $26 million at an average price of $105,856 per coin. This purchase brings Strategy’s total Bitcoin holdings to 592,345 BTC, acquired at an average cost basis of $70,681 per BTC, totaling approximately $41.87 billion in value as of June 22, 2025.

The company also reported a year-to-date Bitcoin yield of 19.2%, further demonstrating its long-standing commitment to using Bitcoin as a central part of its balance sheet strategy. This continued accumulation underscores Strategy’s conviction in Bitcoin’s long-term value proposition and its role as a reserve asset.

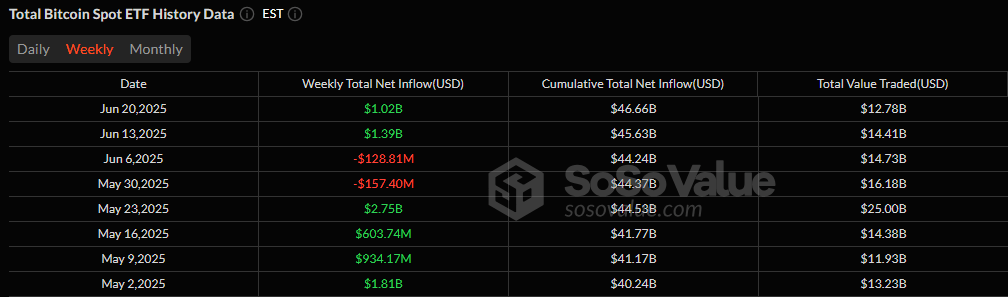

Bitcoin ETFs See Massive $1.02 Billion Inflow: A Sign of Growing Investor Trust

In a week that demonstrated rising confidence in the digital asset space, U.S.-listed Bitcoin exchange-traded funds (ETFs) recorded a combined net inflow of $1.02 billion. This marks the second straight week that inflows surpassed the billion-dollar mark, a trend that indicates institutional investors are steadily increasing their exposure to Bitcoin.

Leading the charge was BlackRock’s IBIT, which brought in $1.23 billion on its own, outpacing competitors and reinforcing its dominant position in the market. Monday, June 16, stood out with a net daily inflow of $412.2 million—setting the tone for a green week across the board. Other notable ETFs showing gains included Bitwise’s BITB ($29.85M), Grayscale’s Bitcoin Mini Trust ($14.93M), and Hashdex’s DEFI fund ($1.17M).

The consistent capital inflow reflects a growing consensus: Bitcoin is increasingly viewed not as a speculative asset but as part of a diversified investment strategy.

The GENIUS Act: Why U.S. Crypto Regulation Is Finally Bringing Stability

On Tuesday evening, the U.S. Senate passed the GENIUS Act, short for Government Engagement in the Nurturing and Innovation of the U.S. Digital Asset Sector. For an industry that has often operated under regulatory uncertainty, this bill represents a turning point. While regulation is often met with resistance, many in the crypto community view this development as a long-awaited signal of legitimacy.

The Act aligns several government agencies—including the SEC and CFTC—toward a more structured approach to crypto oversight. SEC Chairman Paul Atkins has even voiced support for users’ right to self-custody, adding another layer of reassurance to the market.

The United States is not alone in this shift. Europe’s MiCA framework and the UAE’s blockchain-friendly policies show that global jurisdictions are beginning to take digital assets seriously. For investors, regulation brings predictability, and that predictability leads to sustainable capital flow.

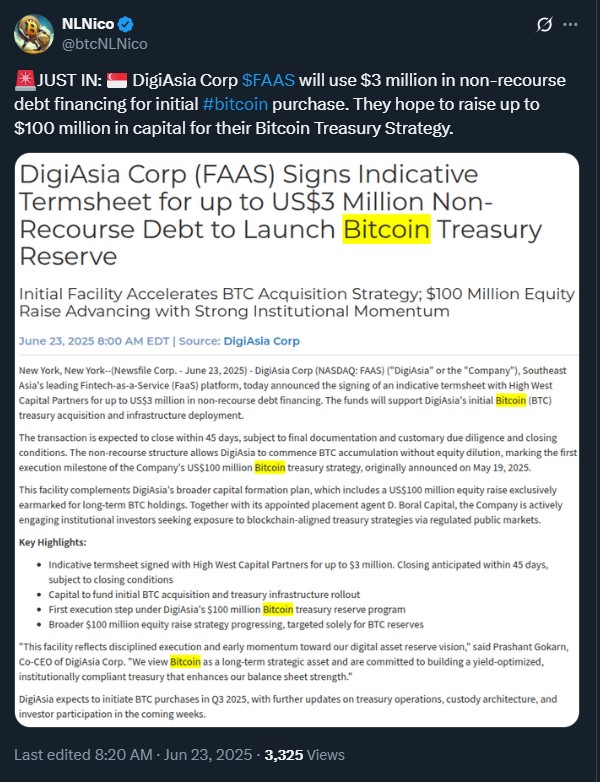

DigiAsia’s $100M Bitcoin Treasury Plan Signals Corporate Confidence in Crypto

Fintech company DigiAsia Corp is moving aggressively into Bitcoin. The Southeast Asian firm is launching a $100 million Bitcoin treasury strategy designed to hold the asset long-term. Initial funding includes a $3 million non-recourse loan from High West Capital Partners, enabling the company to begin buying Bitcoin without affecting shareholder equity.

The company also plans a $100 million equity raise aimed exclusively at acquiring more Bitcoin. DigiAsia sees this initiative not as a short-term trade but as a core part of its financial infrastructure. With plans to integrate Bitcoin into its existing fintech offerings, the company is providing a blueprint for how digital assets can complement traditional finance.

DigiAsia’s NASDAQ listing adds another layer of credibility, offering institutional investors a regulated entry point to Bitcoin exposure. The timing also aligns with broader market trends showing increased corporate interest in digital assets as a hedge against currency risk.

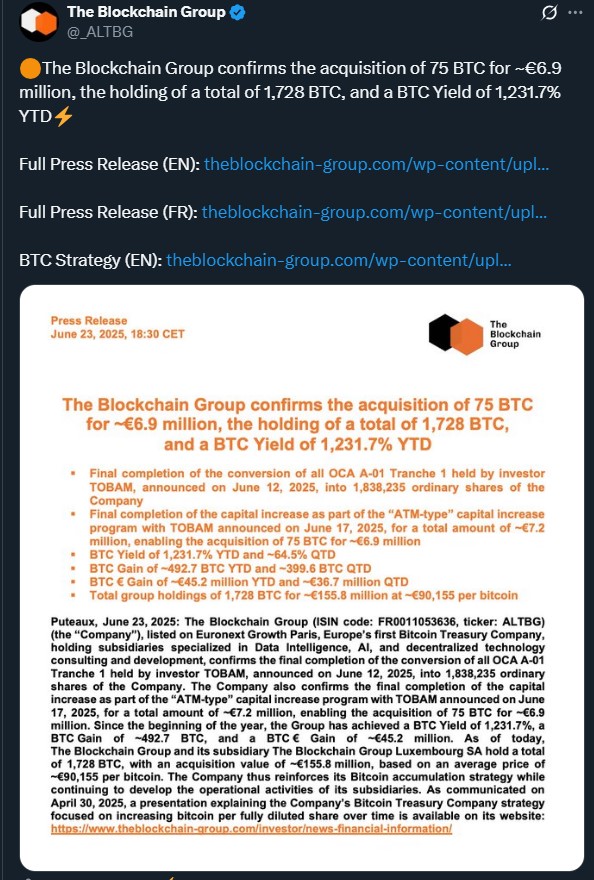

The Blockchain Group Strengthens BTC Holdings Amid Explosive Yield Growth

Europe’s The Blockchain Group (ALTBG), traded on Euronext Growth Paris, recently acquired 75 additional BTC using proceeds from a €7.2 million capital raise. With this move, the company’s total holdings now stand at 1,728 BTC, worth approximately €155.8 million.

ALTBG is reporting a staggering year-to-date BTC yield of 1,231.7%. For the current quarter alone, its BTC gains sit at 399.6 BTC, reflecting a quarterly yield of 64.5%. These figures suggest a methodical strategy that is paying off.

The acquisition was funded through an ATM-style equity program, with participation from institutional investors like TOBAM. The firm has also leveraged non-traditional financing tools, including convertible bonds and share warrants, to support its treasury expansion without overleveraging.

Custody of these assets is managed through Swiss digital infrastructure provider Taurus, with transactions facilitated by banks including Swissquote and Banque Delubac.

How Regulatory, Banking, and Accounting Clarity Is Shaping Crypto’s Future

What makes this moment in crypto unique is the alignment across several key areas:

Together, these updates are helping transition crypto from a loosely defined asset class to one that can be reliably used in corporate finance, investment portfolios, and banking operations.

These developments don’t just remove friction—they open doors. Clarity creates confidence, and confidence encourages participation from large financial institutions, corporate treasuries, and even retail investors who previously sat on the sidelines.

Conclusion

This past week in crypto has shown us what happens when clarity meets momentum. Bitcoin ETFs are drawing record inflows. Companies like DigiAsia and The Blockchain Group are moving forward with long-term Bitcoin strategies. And regulation is finally catching up with innovation.

The story of digital assets is no longer about early adoption. It’s about structured growth and professional participation. The numbers don’t lie, and the direction is clear.

Latest Crypto News;

- Crypto News: Bitcoin Rebounds, Coinbase MiCA license, OKX IPO

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market

- Solana, XRP, and Dogecoin ETFs

- Project 11 Raised $6M to Fix Flaw Behind Bitcoin’s Iron Wall

- Bitcoin Mining Moves to the U.S. as Trade War and Security Fears Grow

- Crypto News Flash: Metaplanet Surpasses Coinbase,

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF

- Bitcoin Slumps, Ethereum’s $1B Play, and the SEC’s New Stance

- How Wall Street, Germany, and GameStop Are Changing the Rules?

- Ethereum’s $110B DeFi Surge, Bullish and Gemini IPOs

- Paraguay Hack, Circle IPO Boom, and Hong Kong’s Chainlink CBDC Pilot

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO

- Bitcoin News: JPMorgan, MoonPay, and K-Wave Drive BTC Adoption

- Why Ethereum Is Attracting More Institutional Capital

- Bitcoin Hits New All-Time High: What’s Next?