Two long-forgotten Bitcoin wallets suddenly came back to life after sitting idle for more than 14 years. Each held 10,000 BTC—now worth over $2.18 billion combined.

Why the Dormant Bitcoin Wallets Are Causing a Stir

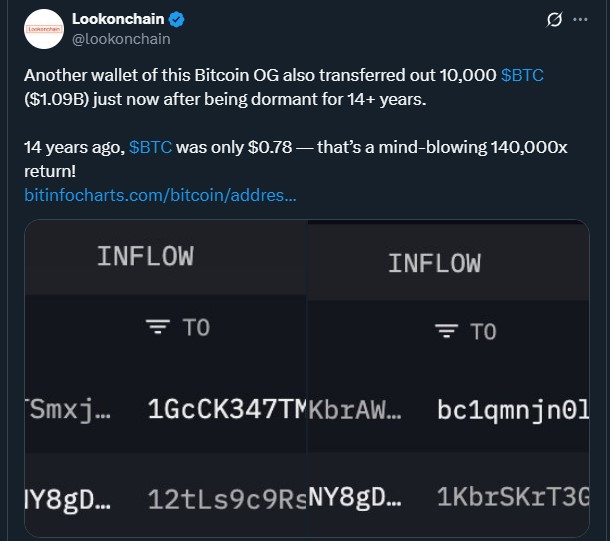

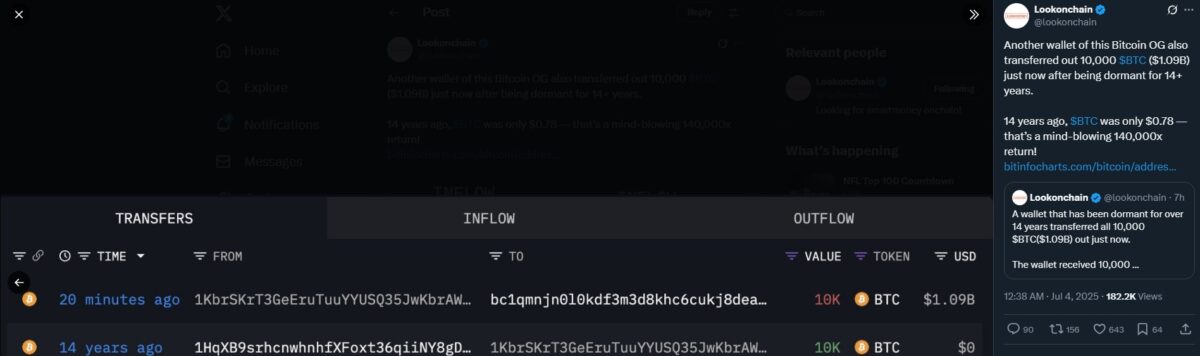

Two wallets funded in 2011, when Bitcoin was just $0.78, remained untouched for over a decade. Suddenly, both transferred all their BTC within 30 minutes.

Back in April 2011, a single Bitcoin address sent nearly 23,400 BTC to three different wallets. Two of those received exactly 10,000 BTC each. These two wallets never moved their funds—until now. In a coordinated move, both sent their entire balances to new addresses within just half an hour.

At the time of the original transfer, 20,000 BTC was worth around $15,600. Today, that same amount is valued at more than $2.18 billion—a gain of nearly 14 million percent.

The fact that both wallets moved simultaneously raises questions. Are they controlled by the same individual or group? Was this part of a planned financial strategy? The new wallets that received the funds haven’t moved them since, and no direct links to exchanges have been found.

Such long-term wallet dormancy followed by sudden activity is rare. It often signals deeper market behavior or insider strategy rather than casual movement. This isn’t just a story about old Bitcoin—it’s a sign of potential market change.

What Blockchain Data Tells Us About the Move

On-chain activity shows no signs of panic selling. The transfer appears deliberate and possibly linked to asset restructuring or security upgrades.

Analyzing blockchain data reveals more layers to this story. The two old wallets used an outdated format, while the new addresses receiving the 20,000 BTC are in a modern, more secure format. This suggests the owner may be reorganizing their holdings, not offloading them.

Timing also plays a role. Both wallets moved within 30 minutes, a strong sign that the activity was coordinated. Whether this was done by one person or a group isn’t confirmed, but the precision indicates careful planning.

Also important is the destination. So far, none of the BTC appears to have been sent to an exchange. That’s usually a telltale sign of intent to sell. Since that hasn’t happened, the market hasn’t reacted negatively.

Blockchain watchers often use signals like Coin Days Destroyed (CDD) to track movement of long-held coins. CDD likely spiked from this event, showing older coins being reactivated. Yet even with such a large movement, Bitcoin’s price has stayed steady.

How This Affects the Bitcoin Market and What to Watch Next

Despite the massive transfer, Bitcoin’s price remains stable. Analysts say this could be a setup for larger strategic moves rather than a quick cash-out.

Interestingly, the market hasn’t panicked. Bitcoin is still trading comfortably above the $100,000 mark, showing resilience despite the activation of these “sleeper” wallets.

The absence of selling pressure points to possible long-term intentions. These could include cold storage updates, preparation for institutional custody, or private over-the-counter deals. Whatever the reason, the precision and timing suggest that the person or team behind the wallets is experienced and well-informed.

Final Thoughts

Two dormant Bitcoin wallets moved over $2 billion in BTC after 14 years of silence—without triggering market chaos. That alone is a strong sign of how much the industry has matured.

The transfer could mean many things: asset restructuring, security upgrades, or preparations for future plans. But one thing is clear—this wasn’t a panic move. It was calculated and quiet.

Latest Crypto News;

- 3 Key Drivers of Bitcoin’s Upcoming Breakout

- Coinbase Buys Liquifi While Tether Faces $4B Lawsuit

- Bitcoin ETF Momentum, Trump-Backed Bitcoin Mining,

- Crypto Market News & Updates Jun 30, 2025

- Robinhood Launches Micro Bitcoin, Solana, and XRP Futures

- Bitcoin Hits $40B in Derivative Market

- Why US Crypto Stocks Surged?

- Crypto News: Bitcoin Rebounds, Coinbase MiCA license, OKX IPO

- 7 Real-Time Shifts Driving Fear and Opportunity in the Crypto Market

- Solana, XRP, and Dogecoin ETFs

- Project 11 Raised $6M to Fix Flaw Behind Bitcoin’s Iron Wall

- Bitcoin Mining Moves to the U.S. as Trade War and Security Fears Grow

- Crypto News Flash: Metaplanet Surpasses Coinbase,

- Is it a Crash or DIP? Bitcoin Rebound, Dogecoin Nosedive and Solana ETF