Bitcoin is back in the spotlight, hovering just below its all-time high as institutional investors and corporations scramble to accumulate BTC—while dwindling supply hints at a potential price explosion.

Key Takeaways:

Bitcoin’s Make-or-Break Moment: Key Price Levels to Watch

Bitcoin (BTC) is once again testing its all-time high, trading just under $112,000 as of June 2025. This rally has been fueled by several key factors that suggest the momentum could continue.

The possibility of Federal Reserve rate cuts later this year has boosted risk assets like Bitcoin, especially after a cooler-than-expected inflation report. Institutional interest remains strong, with Bitcoin ETFs now holding over $132 billion in assets, up significantly from $91 billion just two months ago in April. From a technical perspective, BTC recently broke out of a bullish flag pattern, which typically signals further upside potential.

Traders are closely monitoring two critical price zones that could determine Bitcoin’s next major move. The $112,000 level represents immediate resistance, and a decisive break above this point could confirm a new all-time high. Analysts project $137,000 as the next major target if bullish momentum holds. On the downside, $107,000 and $100,000 are key support levels to watch during any market pullbacks.

The Stealth Accumulation Phase: Why BTC Supply Is Drying Up

While Bitcoin’s price action dominates headlines, a quieter but equally important trend is developing behind the scenes: Bitcoin supply is rapidly disappearing from exchanges and over-the-counter trading desks.

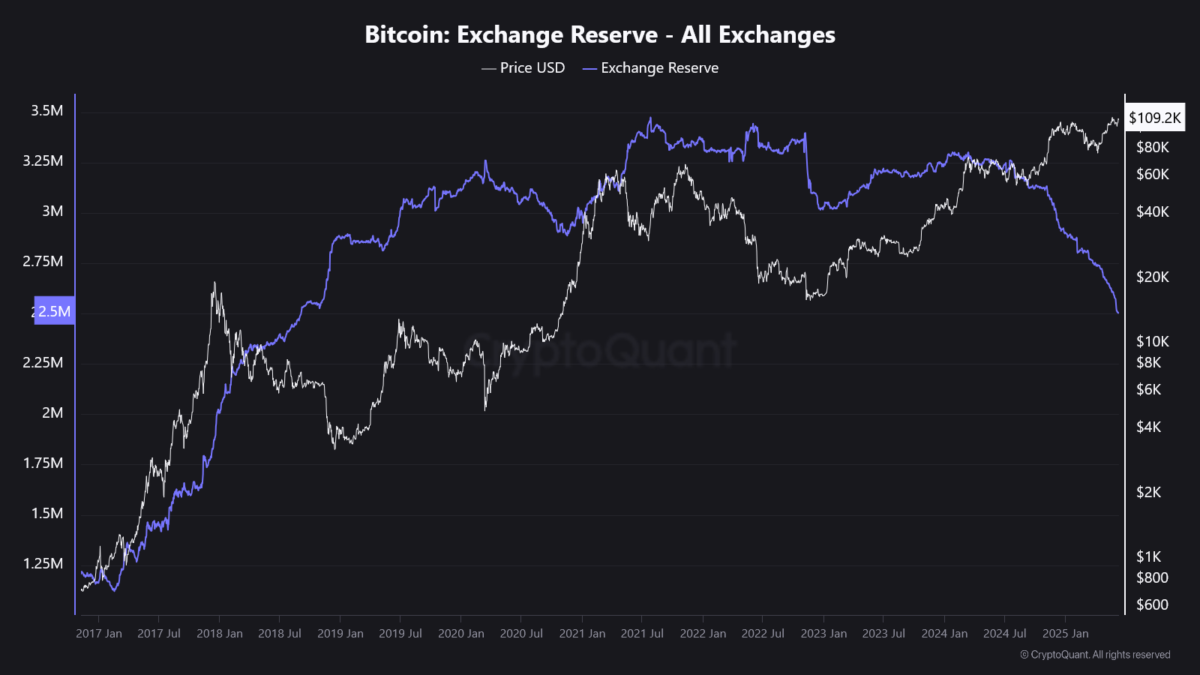

Centralized exchanges have seen their Bitcoin holdings drop by 14% since January 2025, now standing at just 2.5 million BTC – the lowest level since August 2022. This significant outflow suggests investors are moving their Bitcoin into long-term storage solutions like cold wallets rather than keeping it available for trading.

The situation is similar at over-the-counter (OTC) desks, which handle large institutional trades. These platforms are experiencing record-low BTC reserves, with data from CryptoQuant showing a 19% decline in OTC balances since the beginning of the year.

This supply contraction has important implications for the market. When available Bitcoin becomes scarce, even moderate buying pressure can lead to dramatic price movements. With ETF inflows continuing and fewer coins readily available for sale, the conditions are ripe for potentially explosive upside moves in Bitcoin’s price.

GameStop’s Bold Bitcoin Bet Raises Questions

GameStop, the company that became famous as a meme stock, is making waves again – this time with its aggressive Bitcoin accumulation strategy. The video game retailer recently announced a $1.75 billion convertible bond offering, with proceeds likely earmarked for additional Bitcoin purchases.

This move follows GameStop’s initial foray into Bitcoin, where it acquired 4,710 BTC between May and June of this year. The company appears to be following the playbook established by MicroStrategy (now rebranded as Strategy), which has pioneered the corporate Bitcoin treasury model.

However, investors have shown skepticism about GameStop’s strategy. The company’s stock (GME) dropped 11% following the bond offering announcement, suggesting market participants may view this as a risky move by a company taking on substantial debt to chase crypto gains.

The bigger question is whether more companies will follow this trend. Several firms including Trump Media, K33, and Metaplanet have already adopted similar Bitcoin treasury strategies. But as we’ll explore next, some analysts warn that excessive corporate accumulation could create new risks for the Bitcoin market.

Corporate Bitcoin Hoarding: Potential Risks to Market Stability

Strategy, formerly known as MicroStrategy, now holds an astonishing 582,000 BTC – worth over $63 billion and representing nearly 3% of all Bitcoin that will ever exist. While this aggressive accumulation has helped drive demand, it’s also raising concerns among some market observers.

A recent report from Swiss digital asset bank Sygnum highlights potential risks emerging from corporate Bitcoin hoarding. The analysis suggests that companies like Strategy may be distorting Bitcoin’s natural market dynamics. If this trend continues, it could reduce overall market liquidity, increase price volatility, and potentially deter central banks from considering Bitcoin as a reserve asset.

Michael Saylor, Strategy’s co-founder and Bitcoin’s most vocal corporate advocate, maintains that his company’s capital structure can withstand even extreme market conditions. He claims Strategy could survive a 90% Bitcoin price crash lasting several years. However, smaller firms attempting to replicate this model may not have the same financial resilience, creating potential vulnerabilities in the broader market.

Bitcoin’s Dark Side: A Shocking Case of Crypto Crime

Bitcoin’s remarkable rise hasn’t been without controversy, and a recent criminal case in New York highlights the extreme lengths some individuals will go to obtain cryptocurrency.

In a disturbing incident, two investors allegedly kidnapped and tortured a longtime friend over several weeks, attempting to force him to give up access to his Bitcoin wallet. According to prosecutors, the victim suffered horrific abuse including electrocution, pistol-whipping, and even being set on fire.

This extreme case serves as a stark reminder of Bitcoin’s unique risks. While the cryptocurrency offers financial freedom and independence from traditional banking systems, its irreversible transactions and pseudo-anonymous nature can also make it a target for criminals. The incident underscores the critical importance of proper security measures and privacy protections for crypto holders.

Evertz Pharma’s Conservative Bitcoin Approach

Not all corporate Bitcoin strategies involve aggressive accumulation through debt financing. Evertz Pharma, a German natural cosmetics company, has taken a more measured approach by adding 100 BTC (worth approximately €10 million) to its treasury using company profits.

Evertz Pharma’s strategy stands in contrast to the leveraged approach favored by companies like Strategy. The German firm has been gradually accumulating Bitcoin since December 2020 as part of a long-term reserve strategy, viewing it primarily as a hedge against inflation and a way to diversify corporate assets.

This more conservative model could serve as a blueprint for other European businesses considering Bitcoin adoption. By avoiding excessive debt and focusing on gradual accumulation through profits, companies can gain exposure to Bitcoin’s potential upside while maintaining financial stability.

Wall Street’s Growing Bitcoin Embrace

The institutional adoption of Bitcoin continues to expand, with U.S. investment firm F Street becoming the latest to announce Bitcoin treasury plans. The company revealed its intention to accumulate $10 million worth of BTC as part of its corporate strategy.

F Street’s leadership cites Bitcoin’s potential as an inflation hedge as a primary motivation for the move. This perspective aligns with comments from billionaire investor Paul Tudor Jones, who recently described Bitcoin as an essential component of any portfolio designed to combat currency debasement.

In an interesting development, F Street has also committed to providing public proof of reserves for its Bitcoin holdings. This growing trend toward transparency among institutional holders helps build trust in the market and provides stakeholders with verifiable evidence of asset ownership.

Looking Ahead: Bitcoin’s Evolving Role in Global Finance

Bitcoin’s current rally differs from previous bull runs in several important ways. The current momentum appears driven by genuine institutional demand rather than retail speculation, with concrete developments like ETF approvals and corporate adoption providing fundamental support.

However, new challenges are emerging alongside these opportunities. The shrinking supply of Bitcoin on exchanges creates potential for extreme price volatility. The growing concentration of Bitcoin holdings among corporate entities raises questions about long-term market stability. And as Bitcoin becomes more mainstream, it will inevitably face increased regulatory scrutiny.

What remains clear is that Bitcoin has firmly established itself as more than just a speculative asset. It has become a legitimate component of global finance, with all the complexities and responsibilities that entails. As the cryptocurrency continues to evolve, market participants will need to navigate both its tremendous opportunities and its unique challenges.

The coming months will be critical for Bitcoin as it tests key price levels and the market digests the implications of growing institutional involvement. Whether this leads to new all-time highs or a period of consolidation remains to be seen, but one thing is certain: Bitcoin continues to redefine the financial landscape in ways few could have predicted when it first emerged over a decade ago.