Bitcoin just crossed the $110,000 mark — but behind the scenes, the journey is filled with drama, institutional milestones, and global intrigue. Here’s how a hacked presidential account, ETF records, and CBDC experiments shaped the latest crypto surge.

Key Takeaways:

How a Paraguay X-account Hack Sparked a Sudden Bitcoin Spike

In a surprising twist, Bitcoin surged past $110,000 on Monday, following what appeared to be an official announcement from the President of Paraguay, Santiago Peña. His verified X (formerly Twitter) account claimed the country had made Bitcoin legal tender and established a $5 million BTC reserve.

The post was later confirmed to be the result of a hack, with the Presidencia Paraguay swiftly denying the news and deleting the tweet. But the damage — or perhaps the excitement — had already been done.

Investors reacted instantly. The message, written in English and embedded with a wallet address, even called on people to “secure your stake in Bitcoin now.” While the wallet only had $4 in it, the implication of a nation adopting BTC was enough to fuel a 4% gain in Bitcoin’s price.

While this wasn’t the first crypto-related hack of a high-profile figure (Barack Obama and Joe Biden were targeted in a 2020 Bitcoin scam), the stakes were much higher this time. Bitcoin rose above $110,000, hitting its highest level since late May.

Though Paraguay debunked the claim quickly, the event highlights how vulnerable markets can be to misinformation—especially when it comes from what appears to be a credible government source.

Behind the BTC Surge: From $110K to Renewed Market Momentum

While the fake news may have lit the spark, the Bitcoin rally has deeper roots.

At the same time, optimism was building around progress in U.S.–China trade talks, which took place in London. The talks, involving U.S. Commerce Secretary Howard Lutnick, Treasury Secretary Scott Bessent, and China’s Vice Premier He Lifeng, helped reduce market tension. That, combined with a softer economic outlook, gave traders reason to move capital into Bitcoin — often seen as a hedge against uncertainty.

Additionally, Bitcoin’s climb to $110,150 brought it closer to its May 22 peak of $112,000, showing technical strength. Momentum traders re-entered the market, viewing the dip caused by macro pressures in early June as a buying opportunity.

For new investors scanning Bitcoin news, the Paraguay episode might look like a fluke, but the rally is backed by stronger market fundamentals than ever before.

BlackRock’s IBIT ETF Sets New Record in Fastest-Growing Asset Class

If there’s one story in the crypto world that truly signals institutional conviction, it’s the meteoric rise of BlackRock’s Bitcoin ETF (IBIT).

According to Bloomberg, IBIT became the fastest ETF in U.S. history to reach $70 billion in assets, beating even gold ETFs like GLD by a factor of five. It achieved this milestone just 341 days after launch.

For context:

- Fidelity’s FBTC trails behind at $20 billion.

- Grayscale’s GBTC is hovering just under $20 billion.

The ETF’s success speaks volumes. ETFs allow everyday investors and institutions alike to gain exposure to Bitcoin through regulated financial products, removing some of the friction tied to self-custody or trading on crypto exchanges.

Even more impressive, IBIT is now BlackRock’s largest ETF globally, outpacing its own gold fund and becoming the go-to vehicle for investors who want regulated access to Bitcoin’s performance.

This ETF success is also reflected in the broader growth of Bitcoin-focused investment vehicles, all of which show that institutional adoption is no longer a forecast — it’s happening in real-time.

Institutional Confidence Grows: Bitcoin ETFs and Treasury Buys

As ETFs break records, public companies are stepping up their Bitcoin exposure too.

U.S.-listed crypto-linked firms closed Monday in the green, including:

- Core Scientific (CORZ): +4.27% (+0.87% after-hours)

- CleanSpark (CLSK) and MARA Holdings (MARA): each over +3%

- Riot Platforms (RIOT): +2.74% (+1.2% after-hours)

And then there’s Circle (CRCL), which we’ll explore shortly — a standout IPO in crypto’s public market push.

Several firms have also started buying Bitcoin directly to store on their balance sheets, following the blueprint made famous by MicroStrategy. For example:

- BitMine Immersion Technologies bought 100 BTC after a share offering.

- KULR Technology now holds 920 Bitcoin, purchased at an average of $98,760 each, adding $13 million more this week.

This wave of buying shows that holding Bitcoin as a treasury asset is no longer experimental. For many, it’s a strategic hedge — not just against inflation, but against financial system instability.

Hong Kong’s e-HKD Pilot Enters Phase 2 with Chainlink CCIP

In a quieter but equally important move, Hong Kong is forging ahead with CBDC development, entering Phase 2 of its e-HKD program.

One standout element of this phase is the integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This allows different blockchain systems — both permissioned (private) and permissionless (public) — to interact and execute smart contracts in a seamless way.

In the current pilot, an Australian investor uses a stablecoin pegged to the Aussie dollar to buy a tokenized asset in Hong Kong. The transaction moves across chains before being settled in Hong Kong’s CBDC.

Key partners in this initiative include:

- Visa (technology backbone)

- ANZ Bank

- ChinaAMC

- Fidelity International

This signals a growing real-world use case for blockchains beyond speculation. Governments and institutions are now treating crypto infrastructure as viable rails for financial innovation.

Cross-Chain CBDC Use Cases: Settling Tokenized Assets at Scale

The Hong Kong CBDC trial is more than a tech test—it’s a proof of concept for interoperable finance.

By enabling transactions across public and private chains, settlement becomes faster, cheaper, and more transparent. Regulators also gain better visibility into on-chain activity without compromising on user privacy.

While CBDC interest globally has cooled (only 18% of central banks now plan to issue them, down from 38% in 2022), Hong Kong, Israel, and the EU are still pushing forward.

The final report from this study will likely arrive in late 2025, and its findings could set the standard for how central banks integrate blockchain without disrupting existing financial systems.

Global Dynamics: US–China Trade Talks and Crypto Stock Rallies

Beyond crypto itself, macroeconomic factors are playing a critical role in recent market movements.

The recent U.S.–China trade dialogue in London injected a sense of stability into global markets. Following a phone call between President Trump and President Xi, officials met to iron out tariffs and trade terms.

This thaw in tensions, even if temporary, was welcomed by financial markets — especially those seen as risk-on like crypto. As fears of regulatory crackdowns or trade wars eased, Bitcoin regained strength, dragging related equities upward.

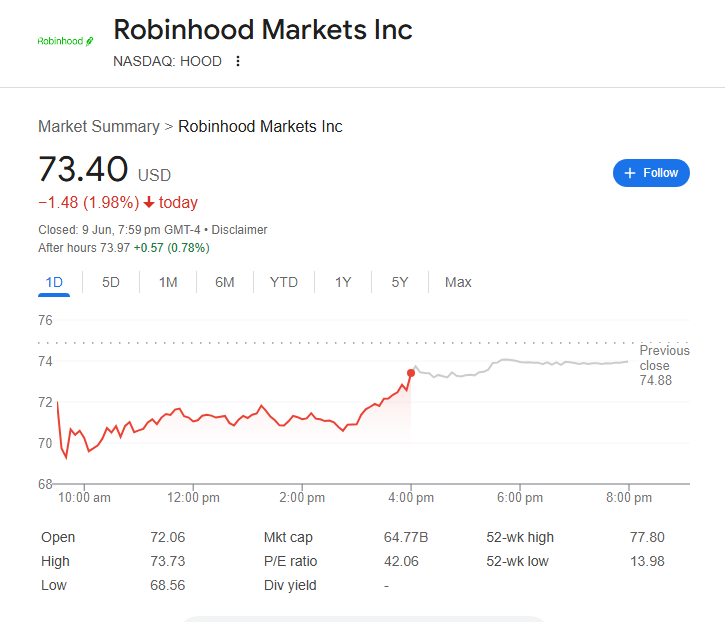

But not everyone benefited. Robinhood (HOOD) dropped 2% after missing out on S&P 500 inclusion — a major disappointment for the trading platform that was expected to be added during the index’s quarterly reshuffle.

In contrast, Coinbase (COIN) and eToro (ETOR) saw modest gains, with the latter rising over 10.5% in one day.

Circle Stock Jumps 270% Post-IPO Amid Stablecoin and Crypto Market Boom

One of the week’s biggest success stories in crypto finance came from Circle Internet Group (CRCL) — the issuer of the USDC stablecoin.

After years of delay, Circle finally went public last week. Since then, its stock has soared over 270%, closing Monday at $115, far above its IPO price of $31.

Why the enthusiasm?

Circle’s IPO comes at a time when regulation for stablecoins is gaining momentum in Congress, and sentiment toward digital assets has shifted thanks to the Trump administration’s public support of crypto innovation.

Analysts say the bullish run is backed by fundamentals:

- Circle manages over $60 billion in circulating USDC.

- It earns significant revenue from interest on cash reserves backing the stablecoin.

- Its competitors are fewer than you’d think — Tether remains the only larger player, with nearly $150 billion in circulation.

Public investors clearly see Circle as more than a stablecoin issuer — it’s now positioned as a financial infrastructure provider for the next generation of finance.

Final Thoughts: A New Era for Bitcoin and Beyond

From viral misinformation to verified institutional milestones, this week in Bitcoin news paints a vivid picture of a market in transition.

Despite short-term volatility caused by social media hacks, the underlying narrative is overwhelmingly bullish:

- ETFs are breaking records.

- Public companies are holding BTC.

- Governments are quietly testing crypto rails.

- Major IPOs are showing explosive market interest.

As regulatory frameworks develop and financial giants continue to integrate crypto, we’re no longer asking if Bitcoin belongs in the global financial system — but how deep its roots will go.

Latest Crypto News:

- Why Michael Saylor Is Betting Big on Bitcoin

- Billionaire’s Conflict Shake-Up and Wake-Up the Crypto Market

- Bitcoin News: Trump vs Musk, Tesla Crash, Circle IPO

- Bitcoin News: JPMorgan, MoonPay, and K-Wave Drive BTC Adoption

- Why Ethereum Is Attracting More Institutional Capital

- Bitcoin Hits New All-Time High: What’s Next?

- How High Can Bitcoin Go in 2025?

- Ripple to Unlock 1 Billion XRP in June 2025

- Ripple joins Hands With Zand Bank and Mamo

- Is XRP Worth Buying? Can XRP Reach $10?

- Ripple Vs SEC Settlement Rejected

- XRP Price Prediction: Massive XRP Breakout Coming?

- XRP News Today: Ripple About to Shatter All-Time Highs?

- How High Can Bitcoin Go in 2025?

- SUI Token Unlock: SUI Price Prediction After Token Unlock