Key Points:

- The US and Mexico have agreed to postpone new tariffs for one month to negotiate border security and trade policies.

- Mexico will deploy 10,000 National Guard troops to its northern border to curb drug trafficking.

- The cryptocurrency market shows signs of recovery following recent declines.

Tariff Delay and Border Security Agreement

In a major development, the United States and Mexico have agreed to delay the implementation of new tariffs for one month. The decision follows discussions between US President Donald Trump and Mexican President Claudia Sheinbaum, aimed at addressing trade and border security concerns.

The proposed tariffs, which included a 25% levy on Mexican and Canadian goods and a 10% tariff on Chinese imports, were set to take effect this week. However, both nations have opted for diplomatic talks to find common ground.

As part of the agreement, Mexico has committed to sending 10,000 National Guard troops to its northern border in an effort to combat drug trafficking. Meanwhile, the US has pledged to take action to prevent high-powered weapons from being smuggled into Mexico.

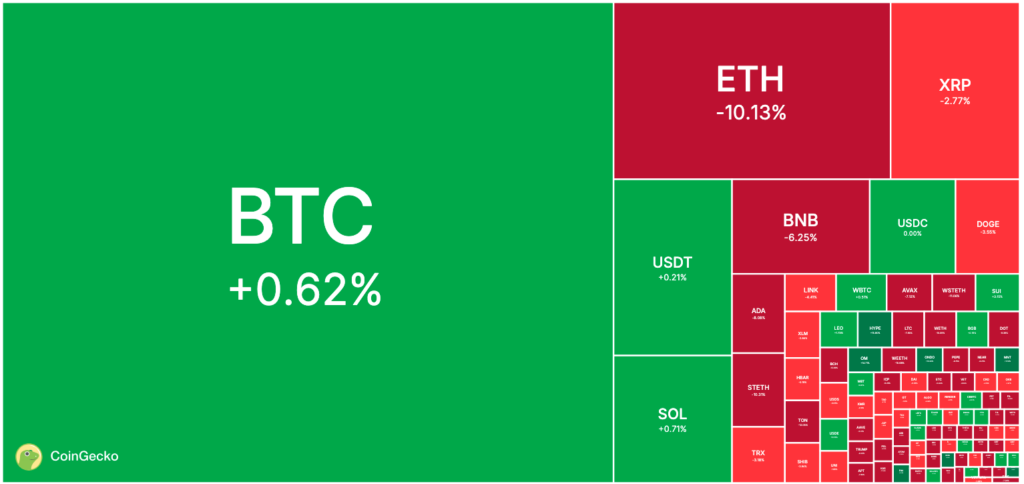

Crypto Market Reacts to Trade Talks

The cryptocurrency market responded positively to the news, with Bitcoin and other major digital assets witnessing an upward trend. The recent uncertainty surrounding tariffs had contributed to market volatility, but investors appear more optimistic following the temporary resolution.

Cryptocurrency Market Insights

Below is a table highlighting the current performance of select cryptocurrencies:

| Cryptocurrency | Price (USD) | 24-Hour Change (%) | Intraday High (USD) | Intraday Low (USD) |

|---|---|---|---|---|

| Bitcoin (BTC) | 99,188.00 | +0.86% | 99,605.00 | 91,995.00 |

| Ethereum (ETH) | 2,731.36 | -9.73% | 3,028.75 | 2,331.05 |

| XRP | 2.65 | -2.93% | 2.73 | 1.98 |

| Litecoin (LTC) | 103.36 | -7.71% | 112.13 | 85.47 |

| Cardano (ADA) | 0.7752 | -7.81% | 0.8409 | 0.5642 |

Data sourced from CoinMarketCap as of February 3, 2025.

The temporary tariff delay brings a sense of stability to financial markets, including cryptocurrencies. Investors will be closely monitoring upcoming trade negotiations, as their outcome could further impact global markets.